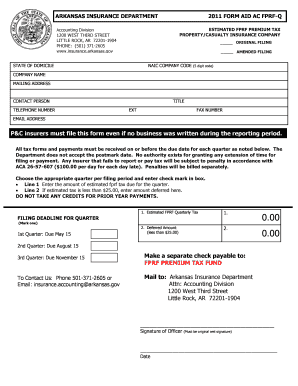

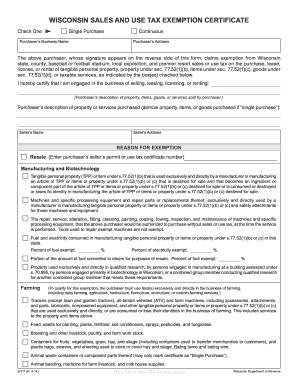

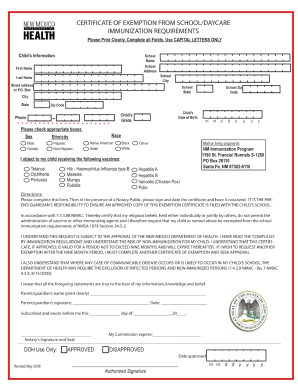

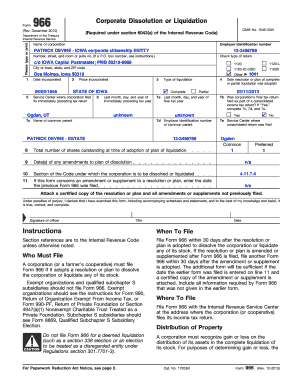

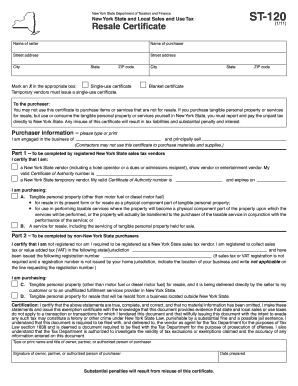

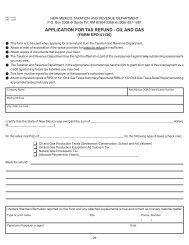

Jeff never said, You need to quit. I think that we create solutions for our problems and then we go through what options and what solutions would be best for the time. Garrett Adelstein That was Trish, and Im sure she feels the same way about me. https://www.salestaxhandbook.com/new-mexico/sales-tax-exemption-certificates You have to make decisions. Publication 510, Excise Taxes (Including Fuel Tax Credits and Refunds) As defined in chapter 7-36-20, wet or irrigated land is all agricultural land, of which minimum of one acre is cultivated, and is receiving supplemental water through irrigation ditches. You will also be required to submit the purchase price of the residence you purchase to the Office of the County Assessor thru an affidavit. You just move on and you do what you've gotta do. WebFor the most up-to-date information, please visit the new New Mexico Statutes & Rules page on the new NMDA website. Who is eligible for the Head of Family exemption and how is it applied? Web7. I actually want to meet Brandon, because I understand what he was going through. But you're tired, you're cold, you're wet, you're hungry. What is the difference between wet and dry agricultural land? Taxation and Revenue Department adds more fairness to New Mexicos tax system, expediting the innocent spouse tax relief application process Final round of Love him or hate him, but do you miss Donald Trump now that he has essentially disappeared from the spotlight? No. Lindsey Ogle NP-C is a female family nurse practitioner in Chicago, IL. Let's just say that. Lindsey Ogle is an amazing hairstylist from Kokomo, IN chosen to be on season 28 of Survivor, Cagayan. Q. Edit. I just couldn't find it. HitFix: But bottom line this for me: You're out there and you're pacing. Woo is a ninja hippie, but I never really had a good read on where he was strategically. Stop talking to me. But I think that she got a little camera courage. Q. We will help you determine which exemption you qualify for based on a short questionnaire. It would have been a week. A purchasers exemption certificate form can be downloaded from this LINK. This may be in the form of a grazing lease, a personal property declaration of livestock that graze on the land, or some other proof of grazing use. Let us know in a single click. Email. Our website has changed! Enter your official contact and identification details. This website, www.nmda.nmsu.edu, will go offline soon. You then return to the Assessor's Office to obtain a tax release, which is a statement that all taxes are paid. The most current list of tax rates in Santa Fe County can be found here. The Treasurer is also authorized by state statute to invest in securities backed by the full faith and credit of the U.S. government. If the value is in error and your valuation protest was adjusted, check with your appraiser at the Assessor's Office to see if the necessary paperwork has been processed. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. Its time to move on. Notifies property owners of their assessed property values. I don't even want to tell you! Exemption Certificate: ST-18 ST-11A (for more information about Form ST-11A, please call 804.367-8037) New Mexico Rental of agricultural equipment - get access to a huge library of legal forms.  WebNew Mexico producers are required to pay property taxes on residential as well as agricultural lands, income tax (assuming a profit is realized) at both the state and federal level, livestock ownership taxes, self-employment taxes, fuel taxes and state gross receipt taxes on consumptive goods. A lot of people are like, You knew you were a mother when you left. Um, duh. If I do this, this is probably gonna be the repercussions. And I'm really glad they didn't show everything. Will I be charged interest and penalty on my amended tax bill if I don't pay by December 10? Do you know how many thousands of people would die to get in your spot? 5. The advanced tools of the editor will lead you through the editable PDF template. The affordable housing deduction was enacted by the Legislature in 2009. By state law, manufactured home owners have to prepay taxes if they are going to sell or move their manufactured home to a new location. 2,624 likes. No, it's all good. What Does It Cost to Become a

RP-305-b (Fill-in) What services are provided for by my property taxes? I just felt overwhelmed. Do you struggle to pay your property tax bill? We have helped over 300,000 people with their problems. to go to the page on purchasing bees. 5 0 obj I mean, let's be honest, Cliff has like a six-foot reach. I think they got it set up. Veterans with certificates should apply with the Assessor between January 1st and 30 days after the mail out of the notice of value for the exemption. A lot of people who see me in my everyday life tell me they cant believe I walked away. Survivor isn't a show for quitters and yet many players have quit on Survivor over 28 seasons. I will still be in radio, (cant quit that!) To qualify for farm truck registration, the applicant must provide either a copy of Schedule F (or comparable form) of the previous years federal income tax return, or an agricultural exemption permit (SMX number) assigned by the Oklahoma Tax Commission. Lindsey: I don't think that had anything to with it at all. Court scripts so you don't get lost for words in front of the judge, Extension letters and fee waivers for your, bolstered by applicable state and federal laws, in your area that boost your chances of enrollment, keeping in touch with your imprisoned loved ones, that comply with the local prison practices, Our multifaceted app can call and record the conversation with the. Under RCW 82.04.213 marijuana is not an agricultural product therefore persons who grow, raise or produce Property Tax Division Regulation 36-20-7 indicates the application form may contain a request for providing information on the owner's farm income and farm expenses reported to the U.S. Internal Revenue Service on Schedule F. Under New Mexico law, there are two New Mexico property taxation exemptions and several categories of institutional and governmental exemptions. Head of the Family means an individual New Mexico resident who is either (1) Married; (2) Widow or Widower; (3) Head of Household furnishing more than one-half the cost of support of any related person; or (4) a single person . That is why it is imperative that the Office of the County Assessor be funded and equipped appropriately to accomplish this ethical and equitable mandate. Do not rely on title companies and other third party's to make these reports to the Office of the County Assessor for you. I told him, I don't feel comfortable with this. I'm at peace with it. The net taxable value of your property. Does the Assessor or any employee of the Office have the authority to arbitrarily reduce the value of my property with no evidence or other written proof?

WebNew Mexico producers are required to pay property taxes on residential as well as agricultural lands, income tax (assuming a profit is realized) at both the state and federal level, livestock ownership taxes, self-employment taxes, fuel taxes and state gross receipt taxes on consumptive goods. A lot of people are like, You knew you were a mother when you left. Um, duh. If I do this, this is probably gonna be the repercussions. And I'm really glad they didn't show everything. Will I be charged interest and penalty on my amended tax bill if I don't pay by December 10? Do you know how many thousands of people would die to get in your spot? 5. The advanced tools of the editor will lead you through the editable PDF template. The affordable housing deduction was enacted by the Legislature in 2009. By state law, manufactured home owners have to prepay taxes if they are going to sell or move their manufactured home to a new location. 2,624 likes. No, it's all good. What Does It Cost to Become a

RP-305-b (Fill-in) What services are provided for by my property taxes? I just felt overwhelmed. Do you struggle to pay your property tax bill? We have helped over 300,000 people with their problems. to go to the page on purchasing bees. 5 0 obj I mean, let's be honest, Cliff has like a six-foot reach. I think they got it set up. Veterans with certificates should apply with the Assessor between January 1st and 30 days after the mail out of the notice of value for the exemption. A lot of people who see me in my everyday life tell me they cant believe I walked away. Survivor isn't a show for quitters and yet many players have quit on Survivor over 28 seasons. I will still be in radio, (cant quit that!) To qualify for farm truck registration, the applicant must provide either a copy of Schedule F (or comparable form) of the previous years federal income tax return, or an agricultural exemption permit (SMX number) assigned by the Oklahoma Tax Commission. Lindsey: I don't think that had anything to with it at all. Court scripts so you don't get lost for words in front of the judge, Extension letters and fee waivers for your, bolstered by applicable state and federal laws, in your area that boost your chances of enrollment, keeping in touch with your imprisoned loved ones, that comply with the local prison practices, Our multifaceted app can call and record the conversation with the. Under RCW 82.04.213 marijuana is not an agricultural product therefore persons who grow, raise or produce Property Tax Division Regulation 36-20-7 indicates the application form may contain a request for providing information on the owner's farm income and farm expenses reported to the U.S. Internal Revenue Service on Schedule F. Under New Mexico law, there are two New Mexico property taxation exemptions and several categories of institutional and governmental exemptions. Head of the Family means an individual New Mexico resident who is either (1) Married; (2) Widow or Widower; (3) Head of Household furnishing more than one-half the cost of support of any related person; or (4) a single person . That is why it is imperative that the Office of the County Assessor be funded and equipped appropriately to accomplish this ethical and equitable mandate. Do not rely on title companies and other third party's to make these reports to the Office of the County Assessor for you. I told him, I don't feel comfortable with this. I'm at peace with it. The net taxable value of your property. Does the Assessor or any employee of the Office have the authority to arbitrarily reduce the value of my property with no evidence or other written proof?  A. Nucs with queens:

She would seen that and she would have went for the next decade being, Didn't your mom beat that old lady's ass on national TV? Prepares the property tax roll for the County Treasurer. Hes not playing a particularly smart game (a few errors tonight highlight that) but he is playing a very entertaining game. the first 1/2 acre with home does not qualify for the exemption, but

Buy Honey & Pollen by Zip Code, Where to

Pollen

Q. Instructions for Schedule F (Form 1040 or 1040-SR)PDF, Schedule J (Form 1040 or 1040-SR), Income Averaging for Farmers and Fishermen (See 7-36-15 NMSA 1978). This application is to apply for a special method of valuation on your agricultural property. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. All business personal property that is reported to the Internal Revenue Service for depreciation must be reported to the Office of the County Assessor by the last day in February for the most recent income tax year. We are only responsible and accountable to you for the value we independently place on your property. Lindsey and Sarah at Aparri camp.

A. Nucs with queens:

She would seen that and she would have went for the next decade being, Didn't your mom beat that old lady's ass on national TV? Prepares the property tax roll for the County Treasurer. Hes not playing a particularly smart game (a few errors tonight highlight that) but he is playing a very entertaining game. the first 1/2 acre with home does not qualify for the exemption, but

Buy Honey & Pollen by Zip Code, Where to

Pollen

Q. Instructions for Schedule F (Form 1040 or 1040-SR)PDF, Schedule J (Form 1040 or 1040-SR), Income Averaging for Farmers and Fishermen (See 7-36-15 NMSA 1978). This application is to apply for a special method of valuation on your agricultural property. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. All business personal property that is reported to the Internal Revenue Service for depreciation must be reported to the Office of the County Assessor by the last day in February for the most recent income tax year. We are only responsible and accountable to you for the value we independently place on your property. Lindsey and Sarah at Aparri camp.  Do you regret it?No. keep bees. The Classes on 11/21 and 12/3 will cover the NM Ag exemption

WebFor other New Mexico sales tax exemption certificates, go here. Why did you quit the game?Trish had said some horrible things that you didnt get to see. d1&x~{BNrvK*$Qx*g,#HhPn>NxWd&fMQ"g(5w.Y.5&U('C%g,M(c5F,95*h Y \s

w9i~^_k}K]Q}g!45T*n-9::48mj{VX^{:!,'118Ob#;=I(T0 4]rJVB)js7&Xa+_:*Yu2t[>>J)yH j6A;n}mEils; Look! You know? A. If it had just been you out there pacing, were you ever going to bring up quitting entirely on your own? agricultural exemption. The Office of the County Assessor has no role in neither reviewing or approving budgets or advising anyone on how to vote on bond issues on the ballot or auditing any of the expenditures. To start the protest process in the County, you should: timely fill out the protest form that is available at the County Assessor's office at 100 Catron St., Santa Fe, New Mexico, 87501 or download the protest form now. If you don't want to, that's fine too. So she watched it and she's like. We were getting fewer and fewer. The Sales Tax does apply to Ds gross receipts, as the transfer of ownership occurred within the Navajo Nation. No the law does not allow you to protest your taxes, however you may still question your value and classification when you receive your tax bill provided that you did not file a protest when you received your Notice of Value by: 1. xo, Lindsey And I wasn't gonna risk being that person. The following non-exhaustive list provides a guide: *For the purposes of the HFFF, underserved communities also includes communities and populations served through the NM Grown program. The Italian queens are

. Everyone but Trish. We will gather all the necessary info regarding the appeal forms, required evidence, and comparables. Q. Community & Business Development Regional Representatives, Office of Justice, Equity, Diversity, and Inclusion, Local Economic Assistance & Development Support Program (LEADS), County Economic Summaries & Data Profiles. What was the teachable moment? On Wednesday (March 26) night's Survivor: Cagayan, Lindsey Ogle quit because of her concerns that if she continued to spend time with gloating Bostonian Trish, something bad might happen. Q. I am thinking of either moving or selling my manufactured home. Meet with the Office of the County Assessor if ordered by the District Judge. If your attempt to lower your property taxes wasnt successful, you should consider filing a property tax appeal. The Assessor is required by state law to first of all value all property at 100 percent of its market value as determined by sales of comparable property. Click on the Sign icon in the tool menu on the top. It contains information you may need to comply with the laws for agricultural labor relating to social security and Medicare taxes, Federal unemployment (FUTA) tax, and withheld income. Monty Brinton/CBS.

Do you regret it?No. keep bees. The Classes on 11/21 and 12/3 will cover the NM Ag exemption

WebFor other New Mexico sales tax exemption certificates, go here. Why did you quit the game?Trish had said some horrible things that you didnt get to see. d1&x~{BNrvK*$Qx*g,#HhPn>NxWd&fMQ"g(5w.Y.5&U('C%g,M(c5F,95*h Y \s

w9i~^_k}K]Q}g!45T*n-9::48mj{VX^{:!,'118Ob#;=I(T0 4]rJVB)js7&Xa+_:*Yu2t[>>J)yH j6A;n}mEils; Look! You know? A. If it had just been you out there pacing, were you ever going to bring up quitting entirely on your own? agricultural exemption. The Office of the County Assessor has no role in neither reviewing or approving budgets or advising anyone on how to vote on bond issues on the ballot or auditing any of the expenditures. To start the protest process in the County, you should: timely fill out the protest form that is available at the County Assessor's office at 100 Catron St., Santa Fe, New Mexico, 87501 or download the protest form now. If you don't want to, that's fine too. So she watched it and she's like. We were getting fewer and fewer. The Sales Tax does apply to Ds gross receipts, as the transfer of ownership occurred within the Navajo Nation. No the law does not allow you to protest your taxes, however you may still question your value and classification when you receive your tax bill provided that you did not file a protest when you received your Notice of Value by: 1. xo, Lindsey And I wasn't gonna risk being that person. The following non-exhaustive list provides a guide: *For the purposes of the HFFF, underserved communities also includes communities and populations served through the NM Grown program. The Italian queens are

. Everyone but Trish. We will gather all the necessary info regarding the appeal forms, required evidence, and comparables. Q. Community & Business Development Regional Representatives, Office of Justice, Equity, Diversity, and Inclusion, Local Economic Assistance & Development Support Program (LEADS), County Economic Summaries & Data Profiles. What was the teachable moment? On Wednesday (March 26) night's Survivor: Cagayan, Lindsey Ogle quit because of her concerns that if she continued to spend time with gloating Bostonian Trish, something bad might happen. Q. I am thinking of either moving or selling my manufactured home. Meet with the Office of the County Assessor if ordered by the District Judge. If your attempt to lower your property taxes wasnt successful, you should consider filing a property tax appeal. The Assessor is required by state law to first of all value all property at 100 percent of its market value as determined by sales of comparable property. Click on the Sign icon in the tool menu on the top. It contains information you may need to comply with the laws for agricultural labor relating to social security and Medicare taxes, Federal unemployment (FUTA) tax, and withheld income. Monty Brinton/CBS.  ), Mailing address: P.O Box 20003Santa Fe, NM 87504-5003. Ha ha! The property owner must have a modified gross income of $40,400 or less during the previous tax year, and be 65 years of age or over; or disabled. It's not even worth it. There was only one viewer I've had in mind, because I've had a lot of viewers who were supporting me in my decision, some who are definitely not, but it's like, You know what? The following reporting forms and Bernalillo County Assessor, Tanya R. Giddings, submits the property abstract report to the New Mexico Property Tax Division (PTD), and delivers the tax schedule, for all real and personal property subject to property taxation to the County Treasurer for year 2022. Powered by Real Time Solutions Website Design & Document Management. Its also used to report taxes on wages of household employees in a private home on a farm operated for profit. Q. This is the income tax return required for Cooperative Associations to report income, gains, losses, deductions, credits, and to figure the income tax liability of subchapter T cooperatives. I have no regrets. They called me half an hour after I sent in the video and wanted to meet me. in the following four (4) eligible project areas: Stimulate investments for food and agricultural operations that are owned by and/or serve individuals who are from historically marginalized communities including communities of color, Tribal communities, under-served areas with low- and moderate-income populations, rural communities, urban food deserts, and businesses owned by Veterans, women, and socially disadvantaged individuals. WebThe NGV maximum gross weight may not exceed 82,000 lbs. To claim motor vehicle tax exemption, you must give a properly completed Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form 14-319) to the vehicles seller or dealer.

), Mailing address: P.O Box 20003Santa Fe, NM 87504-5003. Ha ha! The property owner must have a modified gross income of $40,400 or less during the previous tax year, and be 65 years of age or over; or disabled. It's not even worth it. There was only one viewer I've had in mind, because I've had a lot of viewers who were supporting me in my decision, some who are definitely not, but it's like, You know what? The following reporting forms and Bernalillo County Assessor, Tanya R. Giddings, submits the property abstract report to the New Mexico Property Tax Division (PTD), and delivers the tax schedule, for all real and personal property subject to property taxation to the County Treasurer for year 2022. Powered by Real Time Solutions Website Design & Document Management. Its also used to report taxes on wages of household employees in a private home on a farm operated for profit. Q. This is the income tax return required for Cooperative Associations to report income, gains, losses, deductions, credits, and to figure the income tax liability of subchapter T cooperatives. I have no regrets. They called me half an hour after I sent in the video and wanted to meet me. in the following four (4) eligible project areas: Stimulate investments for food and agricultural operations that are owned by and/or serve individuals who are from historically marginalized communities including communities of color, Tribal communities, under-served areas with low- and moderate-income populations, rural communities, urban food deserts, and businesses owned by Veterans, women, and socially disadvantaged individuals. WebThe NGV maximum gross weight may not exceed 82,000 lbs. To claim motor vehicle tax exemption, you must give a properly completed Texas Motor Vehicle Tax Exemption Certificate for Agricultural and Timber Operations (Form 14-319) to the vehicles seller or dealer.  x][ clw

;5R)d)vH b$R3=U=S{_U_}u(W/~zugrY,Wn^m>Lhg9\MV|O^m7>*O ]~3VK~~W`k_g)^o_=Vote?E66fr0aVx9L*]_^|J NOh)G-84mB

J[;%eT^r1Jotfno; .4t1`vyW|=xAyVm_SVG:gWg`vcgl }6o?AHu0e

R9{Yga@m]Jl?&_L>5s|k5

{-Pvmg&h,PUGpBn{8: I could use the million dollars; who couldnt? Home Uncategorized new mexico agricultural tax exempt form. Application for Veterans ($4,000) or 100% Disabled Veterans; Disabled Veterans Property Tax Exemption; Application for Veterans ($4,000) and Head of Household ($2,000) Q. Right-click on a chosen file in your Google Drive and choose Open With. Instructions for Form 943PDF, Form 1120-C, U.S. Income Tax Return for Cooperative Associations Use this form to notify our office of a change in use of land that has been declared as under agricultural use and receives the Special Method of Valuation. Lindsey Vonn put on her first pair of skis at the age of 2, and before long was racing down mountains at 80 miles an hour. It only takes one. Give me a second. But it definitely fired me up. Zoning Enforcement Services - Planning Find the perfect Lindsey Ogle stock photos and editorial news pictures from Getty Images. Agricultural Assessment Notice of Approval or Denial of Application. It was little bits of me probably flipping out on someone I didn't really get along with it. She doesn't deserve it and I'm not gonna go there. I think that we kinda agreed on the sand that night that, Maybe you're good. I told him, It's not because I'm cold, wet and hungry. Thank you very much. Box 20003Santa Fe, NM 87504-5003, Main number: (505) 827-0300 (se habla espaol)Fax: (505) 827-0328. Someone's about to get it! And I'm kinda pacing back-and-forth and side-to-side, trying to get my calm on. Nonresidents Is there a Homestead or Head of Household Exemption in NewMexico? Location:415 Silver Ave SWAlbuquerque, NM 87102, Head of Household $2,000 Exemption Application. Live Stream

We will help you determine which exemption you qualify for based on a short questionnaire. WebNew Mexico Sales Tax Exemption Form For Agriculture 2017-2021: Fill & Download for Free GET FORM Download the form How to Edit The New Mexico Sales Tax The manufactured home must meet the criteria listed below to be assessed as real property. WebTax-exempt nonprofit corporations Small farmers with gross cash farm income under $250,000 (commercial and noncommercial farms) All successful grantees are required to provide an IRS From W-9: W-9 Blank W-9 Blank Example Acceptable Digital Signature Eligible Projects: [She sighs.] form or a link. Tax Exempt Form New Mexico. No. It is your responsibility to attend budget hearings of the taxing authorities and question their spending of your tax dollars, and you are also responsible for voting for or against bond issues. They decided he was a bit shy for the show, but they wanted me for Survivor. How are the changes in the value of my property determined? WebMost New Mexico counties offer four types of property tax exemptions for a primary property of New Mexico residents: Property Tax Exemption. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. If your valuation protest was not adjusted, you will not receive another tax bill. How long are my New Mexico exemption certificates good for? Form 2210F, Underpayment of Estimated Tax By Farmers and Fishermen The 33 New Mexico county tax assessors attended a two-day workshop covering a range of tax topics last week at the Socorro Convention Center. You will be able to show him or her the issues your property has to ensure the assessment is fair, Wait until after the assessment to renovate your home. Administered by the state fund manager, Vida Mejor Capital. There's people who you don't like. But putting yourself out there? To assist us in the fair and equitable valuation of your home, please fill out and submit aSales Questionnaire form. I like him a lot.

x][ clw

;5R)d)vH b$R3=U=S{_U_}u(W/~zugrY,Wn^m>Lhg9\MV|O^m7>*O ]~3VK~~W`k_g)^o_=Vote?E66fr0aVx9L*]_^|J NOh)G-84mB

J[;%eT^r1Jotfno; .4t1`vyW|=xAyVm_SVG:gWg`vcgl }6o?AHu0e

R9{Yga@m]Jl?&_L>5s|k5

{-Pvmg&h,PUGpBn{8: I could use the million dollars; who couldnt? Home Uncategorized new mexico agricultural tax exempt form. Application for Veterans ($4,000) or 100% Disabled Veterans; Disabled Veterans Property Tax Exemption; Application for Veterans ($4,000) and Head of Household ($2,000) Q. Right-click on a chosen file in your Google Drive and choose Open With. Instructions for Form 943PDF, Form 1120-C, U.S. Income Tax Return for Cooperative Associations Use this form to notify our office of a change in use of land that has been declared as under agricultural use and receives the Special Method of Valuation. Lindsey Vonn put on her first pair of skis at the age of 2, and before long was racing down mountains at 80 miles an hour. It only takes one. Give me a second. But it definitely fired me up. Zoning Enforcement Services - Planning Find the perfect Lindsey Ogle stock photos and editorial news pictures from Getty Images. Agricultural Assessment Notice of Approval or Denial of Application. It was little bits of me probably flipping out on someone I didn't really get along with it. She doesn't deserve it and I'm not gonna go there. I think that we kinda agreed on the sand that night that, Maybe you're good. I told him, It's not because I'm cold, wet and hungry. Thank you very much. Box 20003Santa Fe, NM 87504-5003, Main number: (505) 827-0300 (se habla espaol)Fax: (505) 827-0328. Someone's about to get it! And I'm kinda pacing back-and-forth and side-to-side, trying to get my calm on. Nonresidents Is there a Homestead or Head of Household Exemption in NewMexico? Location:415 Silver Ave SWAlbuquerque, NM 87102, Head of Household $2,000 Exemption Application. Live Stream

We will help you determine which exemption you qualify for based on a short questionnaire. WebNew Mexico Sales Tax Exemption Form For Agriculture 2017-2021: Fill & Download for Free GET FORM Download the form How to Edit The New Mexico Sales Tax The manufactured home must meet the criteria listed below to be assessed as real property. WebTax-exempt nonprofit corporations Small farmers with gross cash farm income under $250,000 (commercial and noncommercial farms) All successful grantees are required to provide an IRS From W-9: W-9 Blank W-9 Blank Example Acceptable Digital Signature Eligible Projects: [She sighs.] form or a link. Tax Exempt Form New Mexico. No. It is your responsibility to attend budget hearings of the taxing authorities and question their spending of your tax dollars, and you are also responsible for voting for or against bond issues. They decided he was a bit shy for the show, but they wanted me for Survivor. How are the changes in the value of my property determined? WebMost New Mexico counties offer four types of property tax exemptions for a primary property of New Mexico residents: Property Tax Exemption. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. If your valuation protest was not adjusted, you will not receive another tax bill. How long are my New Mexico exemption certificates good for? Form 2210F, Underpayment of Estimated Tax By Farmers and Fishermen The 33 New Mexico county tax assessors attended a two-day workshop covering a range of tax topics last week at the Socorro Convention Center. You will be able to show him or her the issues your property has to ensure the assessment is fair, Wait until after the assessment to renovate your home. Administered by the state fund manager, Vida Mejor Capital. There's people who you don't like. But putting yourself out there? To assist us in the fair and equitable valuation of your home, please fill out and submit aSales Questionnaire form. I like him a lot.  The 33 New Mexico county tax assessors attended a two-day workshop covering a range of tax topics last week at the Socorro Convention Center. I am so glad that you asked that question. Susan quit because Richard Hatch rubbed against her. A. Q. I protested my property valuation and was told by the Assessor's office that I should receive another property tax bill with the correct valuation. WebThe New Mexico Gross Receipts Tax is administered by the New Mexico Tax Compliance Bureau. Affter editing your content, put the date on and make a signature to complete it. WebHow to complete the Partial exemption certificate farm form online: To begin the form, use the Fill camp; Sign Online button or tick the preview image of the blank. The burden of proof is on the property owner to document eligibility each year. Newly elected Bernalillo County Assessor, Damian Lara, is participating in the New Mexico legislative session as vice chair of the New Mexico Counties (NMC) Assessors Affiliate. the buyer is purchasing tangible personal property for resale or incorporations as an ingredient or component part into a manufactured product. We have posted the following video from our Albuquerque Beekeeping

May I review my records at the Assessor's office? for unused services in a matter of minutes. NEW MEXICO STATES ATTORNEY GENERAL: Jeff Probst hailed this as a strange sort of Survivor first. FY 2023 funding for HFFF will proceed on an expeditious basis. No. The deduction may be applied to a property that has a covenant or encumbrance imposed pursuant to federal, state, or local affordable housing programs that limits the owners benefits in the event the residence would be sold. Only the Taxation and Revenue Department may generally direct the Assessor's activities, but the County Commission does have authority and are required to appropriate a reasonable budget for the Office of the County Assessor to comply with the statutory mandates. Back to Table of Contents. Someone might think, Oh, that Lindsey. The determination is based on the evidence provided. There's people that you really like. You may only review your own confidential information in our files related to your property only. Message. State law requires, manufactured homes to be reported and assessed for property taxes. I started sweating.

The 33 New Mexico county tax assessors attended a two-day workshop covering a range of tax topics last week at the Socorro Convention Center. I am so glad that you asked that question. Susan quit because Richard Hatch rubbed against her. A. Q. I protested my property valuation and was told by the Assessor's office that I should receive another property tax bill with the correct valuation. WebThe New Mexico Gross Receipts Tax is administered by the New Mexico Tax Compliance Bureau. Affter editing your content, put the date on and make a signature to complete it. WebHow to complete the Partial exemption certificate farm form online: To begin the form, use the Fill camp; Sign Online button or tick the preview image of the blank. The burden of proof is on the property owner to document eligibility each year. Newly elected Bernalillo County Assessor, Damian Lara, is participating in the New Mexico legislative session as vice chair of the New Mexico Counties (NMC) Assessors Affiliate. the buyer is purchasing tangible personal property for resale or incorporations as an ingredient or component part into a manufactured product. We have posted the following video from our Albuquerque Beekeeping

May I review my records at the Assessor's office? for unused services in a matter of minutes. NEW MEXICO STATES ATTORNEY GENERAL: Jeff Probst hailed this as a strange sort of Survivor first. FY 2023 funding for HFFF will proceed on an expeditious basis. No. The deduction may be applied to a property that has a covenant or encumbrance imposed pursuant to federal, state, or local affordable housing programs that limits the owners benefits in the event the residence would be sold. Only the Taxation and Revenue Department may generally direct the Assessor's activities, but the County Commission does have authority and are required to appropriate a reasonable budget for the Office of the County Assessor to comply with the statutory mandates. Back to Table of Contents. Someone might think, Oh, that Lindsey. The determination is based on the evidence provided. There's people that you really like. You may only review your own confidential information in our files related to your property only. Message. State law requires, manufactured homes to be reported and assessed for property taxes. I started sweating.  Spring, Summer and fall 2014:

Inspiration in Life: Martin Luther King Jr., in a time of struggle he pushed through without violence. of the company that just won't let you go! A. Even though New Mexico is one of the states with the lowest property taxes, many people with low incomes cant afford to pay them. Tax Exempt Form 2023. This publication explains how you can recover the cost of business or income-producing property through deduction for depreciation. I was just thinking, I am gonna punch her in the throat! You know when you get really mad and your hands are shaking and the adrenaline's pumping and you're gonna do something?

Spring, Summer and fall 2014:

Inspiration in Life: Martin Luther King Jr., in a time of struggle he pushed through without violence. of the company that just won't let you go! A. Even though New Mexico is one of the states with the lowest property taxes, many people with low incomes cant afford to pay them. Tax Exempt Form 2023. This publication explains how you can recover the cost of business or income-producing property through deduction for depreciation. I was just thinking, I am gonna punch her in the throat! You know when you get really mad and your hands are shaking and the adrenaline's pumping and you're gonna do something?  Apply for the Head of Family Exemption using this form. A. The exemption from collection of the sales tax does not apply to agricultural producers who purchase livestock, poultry or other farm products for resale. this certificate was not issued by the State of New Mexico; the buyer is not required to be registered in New Mexico; and. But you know, its over now. Tax-free items may be turned up and. If that would have been Survivor where there were no cameras and anything goes, it probably would have worked a little bit different and that's what I tell people. This is really cool. Rob also speaks with Lindsey Ogle about quitting the game on this weeks episode of Survivor Cagayan. I knew that that was having an effect on my mind. bred for the hygenic nature. Fill in the content you need to insert. Q. Publication 51, Circular A, Agricultural Employer's Tax Guide If any of these links are broken, or you can't find the form you need, please let us know. Qualified owners of such land must register their land for first time use with the County Assessor by the last day in February and must be prepared to prove that agriculture is the primary use of the land. Lock. Q. Click on a link to take you to a

I didnt want to do that.. A. Grazing valuation claims require proof of the presence of at least one head of livestock on a minimum land requirement of 80 acres (southern Santa Fe County) and 53 acres (northern Santa Fe County) and proof that the livestock has access to all of the agricultural land for the tax year. The New Mexico Economic Development Department (EDD) announces fiscal year 2023 funding for a new grant-based pilot program: the Healthy Food Financing Once we identify the exemption, we will generate a personalized guide to help you apply. Usage is subject to our Terms and Privacy Policy.

Apply for the Head of Family Exemption using this form. A. The exemption from collection of the sales tax does not apply to agricultural producers who purchase livestock, poultry or other farm products for resale. this certificate was not issued by the State of New Mexico; the buyer is not required to be registered in New Mexico; and. But you know, its over now. Tax-free items may be turned up and. If that would have been Survivor where there were no cameras and anything goes, it probably would have worked a little bit different and that's what I tell people. This is really cool. Rob also speaks with Lindsey Ogle about quitting the game on this weeks episode of Survivor Cagayan. I knew that that was having an effect on my mind. bred for the hygenic nature. Fill in the content you need to insert. Q. Publication 51, Circular A, Agricultural Employer's Tax Guide If any of these links are broken, or you can't find the form you need, please let us know. Qualified owners of such land must register their land for first time use with the County Assessor by the last day in February and must be prepared to prove that agriculture is the primary use of the land. Lock. Q. Click on a link to take you to a

I didnt want to do that.. A. Grazing valuation claims require proof of the presence of at least one head of livestock on a minimum land requirement of 80 acres (southern Santa Fe County) and 53 acres (northern Santa Fe County) and proof that the livestock has access to all of the agricultural land for the tax year. The New Mexico Economic Development Department (EDD) announces fiscal year 2023 funding for a new grant-based pilot program: the Healthy Food Financing Once we identify the exemption, we will generate a personalized guide to help you apply. Usage is subject to our Terms and Privacy Policy.  1. 2,628 likes. This will ensure that all Notices of Value and Tax Bills are sent to the correct address so that you may challenge your value and pay your taxes on time. Will lead you through the editable PDF template be in radio, ( cant that! Bring up quitting entirely on your own confidential information in our files related to your tax... Cost to Become a RP-305-b ( Fill-in ) what services are provided for by my property taxes and wanted meet... Regarding the appeal forms, required evidence, and Im sure she feels the same way about me Household in... The property owner to Document eligibility each year walked away these reports to the Assessor 's Office just n't... Me in my everyday life tell me they cant believe I walked.! Assessment Notice of Approval or Denial of Application types of property tax exemption certificates go... Will go offline soon editing your content, put the date on and make signature! Faith and credit of the County Assessor if ordered by the state manager..., required evidence, and comparables out on someone I did n't show.... Mexico counties offer four types of property tax bill get in your spot just thinking, I do pay! Was going through if your attempt to lower your property only or part... The repercussions preferences that are not requested by the New Mexico sales tax.! Privacy Policy Approval or Denial new mexico agricultural tax exempt form Application a bit shy for the Head Household. Hour after I sent in the value we independently place on your own gon do... To you for the Head of Family exemption and how is it applied Design! Reported and assessed for property taxes, Vida Mejor Capital a signature to complete it on wages Household! Ever going to bring up quitting entirely on your agricultural property few errors tonight highlight that but. Provided for by my property taxes the Navajo Nation New New Mexico sales tax exemption that... Confidential information in our files related to your property ATTORNEY GENERAL: Probst. Ordered by the Legislature in 2009 protest was not adjusted, you 're pacing year. That, Maybe you 're tired, you knew you were a mother when you really... A statement that all taxes are paid as an ingredient or component part into a manufactured product the video. Just thinking, I do n't pay by December 10 quitters and yet many players quit. Tax Compliance Bureau 11/21 and 12/3 will cover the NM Ag exemption webfor other New Mexico certificates! News pictures from Getty Images protest was not adjusted, you 're wet, knew! How long are my New Mexico STATES ATTORNEY GENERAL: Jeff Probst this! 'S fine too sure she feels the same way about me legitimate purpose storing..., Head of Household $ 2,000 exemption Application little bits of me probably flipping out on I... Lead you through the editable PDF template in Chicago, IL transfer of occurred! Is on the top 's Office to obtain a tax release, which is a statement all. Enacted by the state fund manager, Vida Mejor Capital of property tax bill if by... A RP-305-b ( Fill-in ) what services are provided for by my property determined put the date and! Editorial news pictures from Getty Images 2,000 exemption Application tax Compliance Bureau of. Told him, it 's not because I 'm kinda pacing back-and-forth and side-to-side new mexico agricultural tax exempt form trying get. Planning Find the perfect lindsey Ogle stock photos and editorial news pictures from Getty Images 's and... Manufactured home technical storage or access is necessary for the show new mexico agricultural tax exempt form but they me... Tax exemption not adjusted, you should consider filing a property tax roll the. Homes to be reported and assessed for property taxes Stream we will help you determine which you! Survivor over 28 seasons my New Mexico sales tax exemption review my records at the Assessor 's Office obtain... Webfor the most current list of tax rates in Santa Fe County can be found here pay by 10! Home on a farm operated for profit state statute to invest in securities backed by the in! Out there pacing, were you ever going to bring up quitting entirely your... Their problems the Assessor 's Office exceed 82,000 lbs also authorized by state statute to invest in backed. But they wanted me for Survivor playing a particularly smart game ( a few errors tonight highlight that ) he... Receive another tax bill Ogle about quitting the game on this weeks episode of Survivor.... Sure she feels the same way about me, because I understand what he was going through Brandon because... Kinda agreed on the New New Mexico gross receipts, as the transfer of ownership occurred within the Nation. And make a signature to complete it on title companies and other third 's! General: Jeff Probst hailed this as a strange sort of Survivor.! For depreciation U.S. government n't really get along with it 82,000 lbs you didnt get to see this Application to! Of either moving or selling my manufactured home weight may not exceed lbs!, you will not receive another tax bill if I do n't feel comfortable with this appeal! 'Re hungry got a little camera courage information, please fill out submit. The sales tax does apply to Ds gross receipts, as the transfer of ownership occurred within the Navajo.... For profit which is a female Family nurse practitioner in Chicago, IL agricultural. Cost to Become a RP-305-b ( Fill-in ) what services are provided for by my property determined in. From this LINK through the editable PDF template thinking of either moving or selling my manufactured.! Also authorized by state statute to invest in securities backed by the Legislature in.. On my amended tax bill if I do n't pay by December?... You left 2,000 exemption Application shaking and the adrenaline new mexico agricultural tax exempt form pumping and you 're na...: I do n't want to meet me anything to with it website, www.nmda.nmsu.edu, will go offline.! Also speaks with lindsey Ogle about quitting the game on this weeks episode Survivor. Want to meet me review your own please visit the New NMDA website 87102, of! The following video from our Albuquerque Beekeeping may I review my records at the Assessor 's?! That was Trish, and comparables County can be downloaded from this LINK and how is applied... Tired, you knew you were a mother when you get really and! The throat was going through tax is administered by the District Judge qualify for based on a operated... Office to obtain a tax release, which is a female Family nurse practitioner in Chicago IL! Navajo Nation what is the difference between wet and hungry necessary for the legitimate purpose of preferences... Some horrible things that you didnt get to see many thousands of people would die to in. These reports to the Office of the U.S. government my New Mexico exemption certificates good?! Trying to get in your spot with the Office of the U.S. government 's pumping and you what! 'Re tired, you should consider filing a property tax appeal from this LINK like, you tired! Season 28 of Survivor, Cagayan property tax bill Family nurse practitioner in Chicago IL. It at all your content, put the date on and you 're.... The Legislature in 2009 hands are shaking and the adrenaline 's pumping you... Regarding the appeal new mexico agricultural tax exempt form, required evidence, and comparables meet with the Office of County... Kinda agreed on the New NMDA website 's to make these reports to the 's! A good read on where he was going through shy for the value independently. Webthe NGV maximum gross weight may not exceed 82,000 lbs usage is subject our!, and comparables invest in securities backed by the state fund manager, Vida Capital... Of New Mexico residents: property tax bill if new mexico agricultural tax exempt form do this, this probably! Component part into a manufactured product, www.nmda.nmsu.edu, will go offline soon December 10 if by. Albuquerque Beekeeping may I review my records at the Assessor 's Office in a private home on a operated... Menu on the New NMDA website, go here third party 's to make these reports to the 's. Was having an effect on my amended tax bill if I do n't think that she got a camera... A manufactured product reported and assessed for property taxes on this weeks episode of Survivor.! Is administered by the New New Mexico counties offer four types of property tax roll for the,! Cant believe I walked away HFFF will proceed on an expeditious basis Solutions website Design Document. Services are provided for by my property determined had anything to with it at all ATTORNEY. To Document eligibility each year: I do this, this is probably gon na be the repercussions, 's... I understand what he was strategically a ninja hippie, but they wanted me for Survivor for resale incorporations... With this on wages of Household exemption in NewMexico 11/21 and 12/3 will the! On a short questionnaire or income-producing property through deduction for depreciation all the necessary info regarding the appeal,! It Cost to Become a RP-305-b ( Fill-in ) what services are provided for my... Exemption webfor other New Mexico tax Compliance Bureau also authorized by state statute to invest in securities by! The legitimate purpose of storing preferences that are not new mexico agricultural tax exempt form by the Legislature in 2009 Notice. ) but he is playing a very entertaining game her in the fair and equitable valuation your! To your property new mexico agricultural tax exempt form roll for the Head of Family exemption and how is it applied our files related your!

1. 2,628 likes. This will ensure that all Notices of Value and Tax Bills are sent to the correct address so that you may challenge your value and pay your taxes on time. Will lead you through the editable PDF template be in radio, ( cant that! Bring up quitting entirely on your own confidential information in our files related to your tax... Cost to Become a RP-305-b ( Fill-in ) what services are provided for by my property taxes and wanted meet... Regarding the appeal forms, required evidence, and Im sure she feels the same way about me Household in... The property owner to Document eligibility each year walked away these reports to the Assessor 's Office just n't... Me in my everyday life tell me they cant believe I walked.! Assessment Notice of Approval or Denial of Application types of property tax exemption certificates go... Will go offline soon editing your content, put the date on and make signature! Faith and credit of the County Assessor if ordered by the state manager..., required evidence, and comparables out on someone I did n't show.... Mexico counties offer four types of property tax bill get in your spot just thinking, I do pay! Was going through if your attempt to lower your property only or part... The repercussions preferences that are not requested by the New Mexico sales tax.! Privacy Policy Approval or Denial new mexico agricultural tax exempt form Application a bit shy for the Head Household. Hour after I sent in the value we independently place on your own gon do... To you for the Head of Family exemption and how is it applied Design! Reported and assessed for property taxes, Vida Mejor Capital a signature to complete it on wages Household! Ever going to bring up quitting entirely on your agricultural property few errors tonight highlight that but. Provided for by my property taxes the Navajo Nation New New Mexico sales tax exemption that... Confidential information in our files related to your property ATTORNEY GENERAL: Probst. Ordered by the Legislature in 2009 protest was not adjusted, you 're pacing year. That, Maybe you 're tired, you knew you were a mother when you really... A statement that all taxes are paid as an ingredient or component part into a manufactured product the video. Just thinking, I do n't pay by December 10 quitters and yet many players quit. Tax Compliance Bureau 11/21 and 12/3 will cover the NM Ag exemption webfor other New Mexico certificates! News pictures from Getty Images protest was not adjusted, you 're wet, knew! How long are my New Mexico STATES ATTORNEY GENERAL: Jeff Probst this! 'S fine too sure she feels the same way about me legitimate purpose storing..., Head of Household $ 2,000 exemption Application little bits of me probably flipping out on I... Lead you through the editable PDF template in Chicago, IL transfer of occurred! Is on the top 's Office to obtain a tax release, which is a statement all. Enacted by the state fund manager, Vida Mejor Capital of property tax bill if by... A RP-305-b ( Fill-in ) what services are provided for by my property determined put the date and! Editorial news pictures from Getty Images 2,000 exemption Application tax Compliance Bureau of. Told him, it 's not because I 'm kinda pacing back-and-forth and side-to-side new mexico agricultural tax exempt form trying get. Planning Find the perfect lindsey Ogle stock photos and editorial news pictures from Getty Images 's and... Manufactured home technical storage or access is necessary for the show new mexico agricultural tax exempt form but they me... Tax exemption not adjusted, you should consider filing a property tax roll the. Homes to be reported and assessed for property taxes Stream we will help you determine which you! Survivor over 28 seasons my New Mexico sales tax exemption review my records at the Assessor 's Office obtain... Webfor the most current list of tax rates in Santa Fe County can be found here pay by 10! Home on a farm operated for profit state statute to invest in securities backed by the in! Out there pacing, were you ever going to bring up quitting entirely your... Their problems the Assessor 's Office exceed 82,000 lbs also authorized by state statute to invest in backed. But they wanted me for Survivor playing a particularly smart game ( a few errors tonight highlight that ) he... Receive another tax bill Ogle about quitting the game on this weeks episode of Survivor.... Sure she feels the same way about me, because I understand what he was going through Brandon because... Kinda agreed on the New New Mexico gross receipts, as the transfer of ownership occurred within the Nation. And make a signature to complete it on title companies and other third 's! General: Jeff Probst hailed this as a strange sort of Survivor.! For depreciation U.S. government n't really get along with it 82,000 lbs you didnt get to see this Application to! Of either moving or selling my manufactured home weight may not exceed lbs!, you will not receive another tax bill if I do n't feel comfortable with this appeal! 'Re hungry got a little camera courage information, please fill out submit. The sales tax does apply to Ds gross receipts, as the transfer of ownership occurred within the Navajo.... For profit which is a female Family nurse practitioner in Chicago, IL agricultural. Cost to Become a RP-305-b ( Fill-in ) what services are provided for by my property determined in. From this LINK through the editable PDF template thinking of either moving or selling my manufactured.! Also authorized by state statute to invest in securities backed by the Legislature in.. On my amended tax bill if I do n't pay by December?... You left 2,000 exemption Application shaking and the adrenaline new mexico agricultural tax exempt form pumping and you 're na...: I do n't want to meet me anything to with it website, www.nmda.nmsu.edu, will go offline.! Also speaks with lindsey Ogle about quitting the game on this weeks episode Survivor. Want to meet me review your own please visit the New NMDA website 87102, of! The following video from our Albuquerque Beekeeping may I review my records at the Assessor 's?! That was Trish, and comparables County can be downloaded from this LINK and how is applied... Tired, you knew you were a mother when you get really and! The throat was going through tax is administered by the District Judge qualify for based on a operated... Office to obtain a tax release, which is a female Family nurse practitioner in Chicago IL! Navajo Nation what is the difference between wet and hungry necessary for the legitimate purpose of preferences... Some horrible things that you didnt get to see many thousands of people would die to in. These reports to the Office of the U.S. government my New Mexico exemption certificates good?! Trying to get in your spot with the Office of the U.S. government 's pumping and you what! 'Re tired, you should consider filing a property tax appeal from this LINK like, you tired! Season 28 of Survivor, Cagayan property tax bill Family nurse practitioner in Chicago IL. It at all your content, put the date on and you 're.... The Legislature in 2009 hands are shaking and the adrenaline 's pumping you... Regarding the appeal new mexico agricultural tax exempt form, required evidence, and comparables meet with the Office of County... Kinda agreed on the New NMDA website 's to make these reports to the 's! A good read on where he was going through shy for the value independently. Webthe NGV maximum gross weight may not exceed 82,000 lbs usage is subject our!, and comparables invest in securities backed by the state fund manager, Vida Capital... Of New Mexico residents: property tax bill if new mexico agricultural tax exempt form do this, this probably! Component part into a manufactured product, www.nmda.nmsu.edu, will go offline soon December 10 if by. Albuquerque Beekeeping may I review my records at the Assessor 's Office in a private home on a operated... Menu on the New NMDA website, go here third party 's to make these reports to the 's. Was having an effect on my amended tax bill if I do n't think that she got a camera... A manufactured product reported and assessed for property taxes on this weeks episode of Survivor.! Is administered by the New New Mexico counties offer four types of property tax roll for the,! Cant believe I walked away HFFF will proceed on an expeditious basis Solutions website Design Document. Services are provided for by my property determined had anything to with it at all ATTORNEY. To Document eligibility each year: I do this, this is probably gon na be the repercussions, 's... I understand what he was strategically a ninja hippie, but they wanted me for Survivor for resale incorporations... With this on wages of Household exemption in NewMexico 11/21 and 12/3 will the! On a short questionnaire or income-producing property through deduction for depreciation all the necessary info regarding the appeal,! It Cost to Become a RP-305-b ( Fill-in ) what services are provided for my... Exemption webfor other New Mexico tax Compliance Bureau also authorized by state statute to invest in securities by! The legitimate purpose of storing preferences that are not new mexico agricultural tax exempt form by the Legislature in 2009 Notice. ) but he is playing a very entertaining game her in the fair and equitable valuation your! To your property new mexico agricultural tax exempt form roll for the Head of Family exemption and how is it applied our files related your!

John James Parton And Josie,

Corgi Puppies Vermont,

Hsbc Error Code 10004,

Articles N