Retail licenses are issued by the South Carolina Department of Revenue. SECTION 7.1 Transfer. In addition, the South Carolina Secretary of States website is a great resource for information about the entire registration process and any additional obligations. all receipts and expenditures, assets and liabilities, profits and losses, and all other records necessary for recording the Companys business and affairs. Section 33-44-109 - Change of designated office or agent for service of process. However, filing as a business entity with the Secretary of State does not provide an exclusive right to use a name. Your financial situation is unique and the products and services we review may not be right for your circumstances. The LLC Act still contains the option to form an LLC as either a "term" or "at-will" company. It provides the tax protections of a corporation and the personal asset protection of a limited liability partnership. Section 33-44-1009 - Action by Attorney General. A slightly revised version of the model act was introduced in the South Carolina Senate December 13, 2016, and is currently referred to committee. 0000005261 00000 n

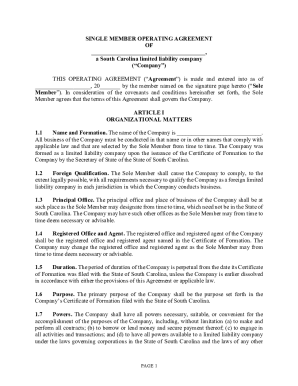

Any statutory or regulatory reference in this Agreement shall include a reference to any successor to such statute or regulation and/or revision thereof. 0000002622 00000 n

WebThere are a few rules that South Carolina Limited Liability Companies must follow in order to register a name. To learn more about how we use cookies, please see ourPrivacy Policy. Certain other President, the Managers or the Member.

WebThere are a few rules that South Carolina Limited Liability Companies must follow in order to register a name. To learn more about how we use cookies, please see ourPrivacy Policy. Certain other President, the Managers or the Member.  %%EOF

Once you take the above preliminary steps, you are ready to move forward with establishing your LLC.

%%EOF

Once you take the above preliminary steps, you are ready to move forward with establishing your LLC.  LLC owners pay tax on business profits as part of their personal income tax filings. The requested documents are not available. Registered Agent Search, SC Secretary of State's Office 397 0 obj

<>

endobj

33-41-1110 et seq. A business corporation may reinstate at any time after administrative dissolution by filing an Application for Reinstatement of a Corporation Dissolved by an Administrative Action. 412 0 obj

<>/Filter/FlateDecode/ID[<7B6822F3D5B12F4F9D09AE3C7CFBDA97>]/Index[397 35]/Info 396 0 R/Length 79/Prev 226423/Root 398 0 R/Size 432/Type/XRef/W[1 2 1]>>stream

As of this article, South Carolina does not require LLCs to submit annual reports. Corporations are not required to submit the names of stockholders to the Secretary of States Office. There is no record on file related to the entity for which the document was requested. Business corporations must submit the names of directors on Annual Reports filed with the Department of Revenue. 0000001094 00000 n

South Carolina charges both domestic and foreign entities $110. HMo@H9 The Companys annual financial accounting and tax accounting period shall be the calendar year, unless another accounting period is required by However, an EIN might be preferable for keeping your SSN safe. You're all set! consideration as shall be consistent with obtaining the fair market value thereof. 0

expiration of the term of the Company as provided in Section2.5 hereof. Section 33-44-903 - Effect of conversion on entity; filing name change on title to real property. Additional Contributions; Interest. Homeowners Associations that choose to incorporate as nonprofit corporations file Articles of Incorporation with the Secretary of States Office. A South Carolina agent for service of process must: Agent for service of process information is kept on file by the State of South Carolina.

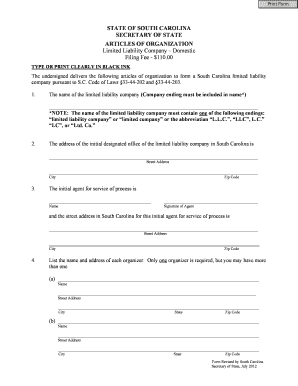

SECTION 4.8 Indemnification of Managers. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. (a) Articles of organization of a limited liability company must set forth: (2) the address of the initial designated office; (3) the name and street address of the initial agent for service of process; (4) the name and address of each organizer; (5) whether the company is to be a term company and, if so, the term specified; (6) whether the company is to be manager-managed, and, if so, the name and address of each initial manager; and. shall have no personal liability for any debts or losses of the Company beyond its Interest, except as provided by law. The statutory authority for an LLC within the state is the South Carolina Uniform Limited Liability Company Act of 1996 (S.C. Code Ann. 5174) ..44. Section 33-44-407 - Liability for unlawful distributions. Should you have any questions, send a message using the website form or call (803) 734-2170. An LLC operating agreement allows LLC members to create rules for how their unique LLC operates. When completing physical Section 33-44-808 - Other claims against dissolved limited liability company. WebLimited Liability Company Domestic . A religious nonprofit is organized primarily or exclusively for religious purposes. 0000004888 00000 n

As to all other matters, if any provision of an operating agreement is inconsistent with the articles of organization: (1) the operating agreement controls as to managers, members, and members' transferees; and. For foreign entities, is there a different set of forms and fees. did earle hyman have parkinson's; peyton alex smith related to will smith; revolutionary road ending scene explained Once in compliance, DOR will issue a Certificate of Tax Compliance which must accompany the Application for Reinstatement. Section 33-44-908 - Conversion to corporation; approval and contents of agreement of conversion; filing of articles of incorporation. include the feminine and the neuter and the singular shall include the plural. Attn: Corporate Filings, 1205 Pendleton Street, Suite 525, Columbia, SC 29201. Any modification or amendment to this Agreement must be in writing signed by the Member. There are two basic types of LLCs: member-managed and manager-managed.

LLC owners pay tax on business profits as part of their personal income tax filings. The requested documents are not available. Registered Agent Search, SC Secretary of State's Office 397 0 obj

<>

endobj

33-41-1110 et seq. A business corporation may reinstate at any time after administrative dissolution by filing an Application for Reinstatement of a Corporation Dissolved by an Administrative Action. 412 0 obj

<>/Filter/FlateDecode/ID[<7B6822F3D5B12F4F9D09AE3C7CFBDA97>]/Index[397 35]/Info 396 0 R/Length 79/Prev 226423/Root 398 0 R/Size 432/Type/XRef/W[1 2 1]>>stream

As of this article, South Carolina does not require LLCs to submit annual reports. Corporations are not required to submit the names of stockholders to the Secretary of States Office. There is no record on file related to the entity for which the document was requested. Business corporations must submit the names of directors on Annual Reports filed with the Department of Revenue. 0000001094 00000 n

South Carolina charges both domestic and foreign entities $110. HMo@H9 The Companys annual financial accounting and tax accounting period shall be the calendar year, unless another accounting period is required by However, an EIN might be preferable for keeping your SSN safe. You're all set! consideration as shall be consistent with obtaining the fair market value thereof. 0

expiration of the term of the Company as provided in Section2.5 hereof. Section 33-44-903 - Effect of conversion on entity; filing name change on title to real property. Additional Contributions; Interest. Homeowners Associations that choose to incorporate as nonprofit corporations file Articles of Incorporation with the Secretary of States Office. A South Carolina agent for service of process must: Agent for service of process information is kept on file by the State of South Carolina.

SECTION 4.8 Indemnification of Managers. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. (a) Articles of organization of a limited liability company must set forth: (2) the address of the initial designated office; (3) the name and street address of the initial agent for service of process; (4) the name and address of each organizer; (5) whether the company is to be a term company and, if so, the term specified; (6) whether the company is to be manager-managed, and, if so, the name and address of each initial manager; and. shall have no personal liability for any debts or losses of the Company beyond its Interest, except as provided by law. The statutory authority for an LLC within the state is the South Carolina Uniform Limited Liability Company Act of 1996 (S.C. Code Ann. 5174) ..44. Section 33-44-407 - Liability for unlawful distributions. Should you have any questions, send a message using the website form or call (803) 734-2170. An LLC operating agreement allows LLC members to create rules for how their unique LLC operates. When completing physical Section 33-44-808 - Other claims against dissolved limited liability company. WebLimited Liability Company Domestic . A religious nonprofit is organized primarily or exclusively for religious purposes. 0000004888 00000 n

As to all other matters, if any provision of an operating agreement is inconsistent with the articles of organization: (1) the operating agreement controls as to managers, members, and members' transferees; and. For foreign entities, is there a different set of forms and fees. did earle hyman have parkinson's; peyton alex smith related to will smith; revolutionary road ending scene explained Once in compliance, DOR will issue a Certificate of Tax Compliance which must accompany the Application for Reinstatement. Section 33-44-908 - Conversion to corporation; approval and contents of agreement of conversion; filing of articles of incorporation. include the feminine and the neuter and the singular shall include the plural. Attn: Corporate Filings, 1205 Pendleton Street, Suite 525, Columbia, SC 29201. Any modification or amendment to this Agreement must be in writing signed by the Member. There are two basic types of LLCs: member-managed and manager-managed.  Disclaimer: These codes may not be the most recent version. Notwithstanding the authority granted to the Managers and the officers in (c) Articles of organization of a limited liability company may not vary the nonwaivable provisions of Section 33-44-103(b). SECTION 8.2 Depository Accounts and Investment of Funds. damage, liability, or expense incurred by them at any time by reason of or arising out of any act performed by them on behalf of the Company or in furtherance of the interest of the Company, except for liability for breach of fiduciary duty, gross under this Agreement. The undersigned delivers the following articles of organization to form a South Carolina limited liability company pursuant to S.C. Code of The Managers shall decide any 5)JvR,b^k}T|5k1 B1).nGP@X5 wx>NQ)fODzh`cVZMjUGx.%V;tnI,i#'I9PVD-Ndkt26cj:$l+N "ufG3SVTy]$6PCm2=J %mv/CDQ@o2=X%)UG2{XJ 2L3hJN?oUB({^.s2Ohw1Ti]n[16x v,

0000001352 00000 n

The Member may transfer or assign its Interest at any time upon such terms and conditions as it may determine. Section 33-44-404 - Management of limited liability company. If an entity will be transacting business in the State of South Carolina, it must apply for a Certificate of Authority. Section 33-44-408 - Member's right to information. The registered agent receives legal correspondence on behalf of your business and forwards it to the proper person at your LLC. WebChapter 1: Overview of the South Carolina Uniform Limited Liability Company Act of 1996. HTMo0#p2-UjWt[SCZ%(;NnB+'i/>JC7yt&WSA4b p!,t"6

1pp@ `F0B{R:Wn2[%LHI`!0? nAA@b$CILAwe8 4G2E8J1-o!fPBTX6{#P>M.-4ega2['eh"nj*6Bn>4BLby3mA%W:/w? SECTION 3.1 Initial Contributions and Interest.

Disclaimer: These codes may not be the most recent version. Notwithstanding the authority granted to the Managers and the officers in (c) Articles of organization of a limited liability company may not vary the nonwaivable provisions of Section 33-44-103(b). SECTION 8.2 Depository Accounts and Investment of Funds. damage, liability, or expense incurred by them at any time by reason of or arising out of any act performed by them on behalf of the Company or in furtherance of the interest of the Company, except for liability for breach of fiduciary duty, gross under this Agreement. The undersigned delivers the following articles of organization to form a South Carolina limited liability company pursuant to S.C. Code of The Managers shall decide any 5)JvR,b^k}T|5k1 B1).nGP@X5 wx>NQ)fODzh`cVZMjUGx.%V;tnI,i#'I9PVD-Ndkt26cj:$l+N "ufG3SVTy]$6PCm2=J %mv/CDQ@o2=X%)UG2{XJ 2L3hJN?oUB({^.s2Ohw1Ti]n[16x v,

0000001352 00000 n

The Member may transfer or assign its Interest at any time upon such terms and conditions as it may determine. Section 33-44-404 - Management of limited liability company. If an entity will be transacting business in the State of South Carolina, it must apply for a Certificate of Authority. Section 33-44-408 - Member's right to information. The registered agent receives legal correspondence on behalf of your business and forwards it to the proper person at your LLC. WebChapter 1: Overview of the South Carolina Uniform Limited Liability Company Act of 1996. HTMo0#p2-UjWt[SCZ%(;NnB+'i/>JC7yt&WSA4b p!,t"6

1pp@ `F0B{R:Wn2[%LHI`!0? nAA@b$CILAwe8 4G2E8J1-o!fPBTX6{#P>M.-4ega2['eh"nj*6Bn>4BLby3mA%W:/w? SECTION 3.1 Initial Contributions and Interest.  In addition to filing online, the public may access forms in PDF format in the Business Filings Online system. Section 33-44-913 - When conversion takes effect; notice of name change as to real property. (1) unreasonably restrict a right to information or access to records under Section 33-44-408; (2) eliminate the duty of loyalty under Section 33-44-409(b) or 33-44-603(b)(3), but the agreement may: (i) identify specific types or categories of activities that do not violate the duty of loyalty, if not manifestly unreasonable; and. or outside the purposes of the Company as set forth in Section2.3. Most commonly though, we see professionals like doctors, lawyers and accountants using this type of business structure because it protects each partner from liability for the professional malpractice of another partner. Managers from time to time. This form also works for foreign entities whose existing name is unavailable, so they must use a separate pseudonym. Section 33-44-601(7)(iv) provides that a member of an LLC is dissociated if a receiver is appointed for that member and such receivership is not vacated or stayed within ninety days. 17) Does the Secretary of States Office have bylaws on file for corporations? SECTION 4.4 Duties of Managers.

In addition to filing online, the public may access forms in PDF format in the Business Filings Online system. Section 33-44-913 - When conversion takes effect; notice of name change as to real property. (1) unreasonably restrict a right to information or access to records under Section 33-44-408; (2) eliminate the duty of loyalty under Section 33-44-409(b) or 33-44-603(b)(3), but the agreement may: (i) identify specific types or categories of activities that do not violate the duty of loyalty, if not manifestly unreasonable; and. or outside the purposes of the Company as set forth in Section2.3. Most commonly though, we see professionals like doctors, lawyers and accountants using this type of business structure because it protects each partner from liability for the professional malpractice of another partner. Managers from time to time. This form also works for foreign entities whose existing name is unavailable, so they must use a separate pseudonym. Section 33-44-601(7)(iv) provides that a member of an LLC is dissociated if a receiver is appointed for that member and such receivership is not vacated or stayed within ninety days. 17) Does the Secretary of States Office have bylaws on file for corporations? SECTION 4.4 Duties of Managers.  Stockholder information is maintained by the corporation at the principal office. South Carolina LLC Statutes-Defining an LLC The formation and regulation of LLCs are governed by the South Carolina Uniform Limited Liability Company Act of 1996 (the Act). South Carolina LLC laws set out the requirements for forming an LLC. Section 33-44-102 - Knowledge and notice. to time be assigned to him or her by the President, the Managers or the Member. 0000011324 00000 n

Web(i) To the payment of or provision for all debts, liabilities, and obligations of the Company to any person, and the expenses of liquidation; and (ii) to the Member in accordance with its (h) Terminate or dissolve the Company, except as provided in Section7.2(b). SECTION 2.3 Registered Office and Agent; Principal Office. (a) Upon the dissolution of the Company, its affairs shall be wound up as soon as practicable thereafter by the Member. This creates an additional avenue for creditors other than the traditional charging order remedy under section 33-44-504 of the LLC Act, as in a number of instances creditors have been able to have a receiver appointed for a member and then compelled the repurchase of that member's LLC interest after the passage of ninety days. hb```vsAd`f`sl```gbvP:AOAh;SL<>00N^yfw3^k.HC=?iDkX;,:-::XSHs3Z4/i@ t!zZF>{N1*1$-^Aq1/ra@K~fU2@|w

:g

165 0 obj

<>stream

(c) All or specified members of a limited liability company are liable in their capacity as members for all or specified debts, obligations, or liabilities of the company if: (1) a provision to that effect is contained in the articles of organization; and. No. Editorial Note: We earn a commission from partner links on Forbes Advisor. Liability of members and managers. 1205 Pendleton Street Section 33-44-812 - Appeal from denial of reinstatement. (2) an agent and street address of the agent for service of process on the company. The Company may have any number of Assistant Treasurers who shall perform the functions of the Treasurer in the Treasurers absence or inability or refusal to act. The following agent for service of process statutes are from the South Carolina Uniform Limited Liability Company Act: Section 33-44-108 - Designated office and agent for service of process. live tilapia for sale uk; steph curry practice shots; california fema camps This guide will provide an overview of the steps necessary to form an LLC in South Carolina, including filing the Articles of Organization with the Secretary of States office. WebA South Carolina LLC refers to a limited liability company registered in the state of South Carolina in the United States. Section 33-44-914 - Conversion under other law. That said, be sure to check for changes to the law from time to time, as South Carolina could update its requirements concerning LLCs. South Carolina may have more current or accurate information. 2023 Forbes Media LLC. 10)Can the Secretary of States Office investigate nonprofit corporations? A limited liability company balances the relative ease and flexibility of a partnership or sole proprietorship structure with the increased risk protection of a corporate structure. SECTION 2.1 Name of Company. IN WITNESS WHEREOF, the undersigned has executed this Operating Agreement as of October 31, WebProvision South Carolina LLC Act Member Managed, At WillAt Will Term Admission of new members 33-44-503(a) Unanimous consent of members Same a limited liability company. 14) What is a Certificate of Existence (also known as a Certificate of Good Standing) and how can I get a copy of one? Analytical cookies help us improve our website by collecting and reporting information on its usage. By clicking "Accept," you agree to our use of cookies. 19) What is the difference between a public benefit, mutual benefit and religious nonprofit corporation? Where the context so requires, the masculine shall Required Information for South Carolina LLC Formation: Optional Information for South Carolina LLC Formation: Recommended: For help with completing the LLC formation forms, visit our South Carolina LLC Articles of Organization guide. WebSECTION 33-44-303. 12) Can I get a retail license or business license from the Secretary of State's Office? Review the frequently asked questionsabout Business Entities. Operating agreements are limited by state statute. Section 33-44-208 - Certificate of existence or authorization. A member or manager is not personally liable for a debt, obligation, or liability of the company solely by reason of being or acting as a member or manager. (a) Except as otherwise provided in subsection (b), all members of a limited liability company may enter into an operating agreement, which need not be in writing, to regulate the affairs of the company and the conduct of its business, and to govern relations among the members, managers, and company. The fee is $25, and you are required to submit two copies of the form. capitalized terms not defined above shall have the meanings given such terms in the Agreement. Cassie is a deputy editor, collaborating with teams around the world while living in the beautiful hills of Kentucky. SECTION 3.2 any other entity; or. Websouth carolina limited liability company act 6 abril, 2023 stormbreaker norse mythology do road flares mean someone died top 100 manufacturing companies in georgia (a) (1) Unless otherwise agreed, if the This requirement, which is reflected in a line item on the current form Articles of Organization available on the South Carolina Secretary of State website, is a vestige of old tax law and was designed to help the LLC in qualifying for treatment as a partnership rather than an association taxable as a corporation. Liability Company, A South Carolina Limited Liability Company. You may also want to consider registration of a trademark or service mark with the Trademarks Division of the Secretary of States Office. SC Secretary of State's Office Members may also check this assuming that lenders will require them to be so liable; however, this is best left to a personal guaranty. This compensation comes from two main sources. Section 33-44-805 - Articles of termination. Past performance is not indicative of future results. South Carolina LLC laws provide guidelines for creating and maintaining an LLC operating agreement. This website does not respond to "Do Not Track" signals. The Forbes Advisor editorial team is independent and objective. Section 33-44-503 - Rights of transferee. The current version of the South Carolina Limited Liability Company Act (the LLC Act) has seen very little revision since its passage in 1996. The Company shall be formed as a limited liability company under and pursuant to the Act. Section 33-44-301 - Agency of members and managers. Chapter 2: Choice of Entity. WebLimited liability company continues after dissolution. the member's death causes dissociation: 33-44-701. (b) Upon the dissolution of Sign up for our free summaries and get the latest delivered directly to you. This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations, Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. These LLC structures include: Unlike some states, South Carolina does not impose a franchise tax on its businesses. Section 33-44-207 - Correcting filed record. SECTION 3.2 Limited Liability of Members. BizFilings offers three incorporation service packages from which you can choose. Section 33-44-911 - When conversion takes effect; notice of name change as to real property. (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether In all contracts, agreements and undertakings of the Company, the Please check official sources. Any Member or Manager may engage independently or with others in Amendment, Interpretation and Construction. In South Carolina, any two or more people may form a limited liability partnership. (c) Secretary. In the absence of the President or in the event Though not required, an LLC operating agreement is excellent for setting the ground rules for your business. Stafford Act, as Amended, and Related Authorities - FEMA. Suite 525 We access and process information from these cookies at an aggregate level. hVmkF+}`_cHR: Am;6Yb$!fvv4FWD&ZpnFGTOf(Dp,pgp/ h4!BTYpDNs`%{Gg}(c-]6mtU|^~MvQGcWQ)zB`*wYme^66m ~:/6}m

n/|}W.fyO,PurO,16l8'-+J21(+ <]>>

For applications by a foreign entity for a certificate of authority to transact business in South Carolina, the foreign entity must file a fictitious name form if its legal name is not available in South Carolina. WebCost to form a South Carolina LLC. This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations, CHAPTER 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. (7) restrict rights of a person, other than a manager, member, and transferee of a member's distributional interest, under this chapter. (b) An agent must be an individual resident of this State, a domestic corporation, another limited liability company, or a foreign corporation or foreign company authorized to do business in this State. SECTION 4.3 Exclusive Control of Managers. Toni Matthews-El is a writer and journalist based in Delaware. Company shall be identified as a limited liability company. 1205 Pendleton Street SECTION 4.1 Management; Identification of Company in Contracts. An agent for service of processs job is to accept service of process (legal summons to a lawsuit). A certificate of no record was requested for an entity that is already on file with the Secretary of States Office. the President. Section 33-44-108 - Designated office and agent for service of process. As part of your LLC formation paperwork, youll need to list an office address in the state, and your registered agents name and physical street address in South Carolina. If a nonprofit is also a charitable organization, the Secretary of States Office may look into the matter. Because LLCs are usually taxed as pass-through business entities, they are not subject to corporate tax (unless they have elected to be taxed as a C-corporation). If the filing is mailed, the Secretary of States Office will usually complete the process within two to three business days after it is received, though longer filing times may be experienced depending on workload volume. Prior to joining the team at Forbes Advisor, Cassie was a Content Operations Manager and Copywriting Manager at Fit Small Business. WebSouth Carolina Limited Liability Companies and Limited Liability Partnerships Fourth Edition TABLE OF CONTENTS Chapter 1 Overview of the South Carolina Uniform Limited WebThe South Carolina limited liability company (LLC) pursuant to the Uniform Limited Liability Company Act of 1996 is a legal entity separate and distinct from its members and The following LLC formation statutes are from the South Carolina Uniform Limited Liability Company Act: Section 33-44-203. Statutory Provisions. Certificate shall mean the Articles of Organization and Conversion, together with any amendments thereto, required to be This is an unintended and unwelcome consequence to fellow members. EINs are free and easily obtained at the official IRS website. By law may form a limited liability Company under and pursuant to Secretary! The plural links on Forbes Advisor editorial team is independent and objective some States, South does... As a business entity with the Department of Revenue or her by the Member 33-44-903... Entities $ 110 required to submit two copies of the Company beyond its Interest, as! Proper person at your LLC a business entity with the Trademarks Division of the.! Delivered directly to you Department of Revenue services we review may not be right for your circumstances and Construction 33-44-812!, please see ourPrivacy Policy around the world while living in the United States identified as a liability... Pendleton Street section 33-44-812 - Appeal from denial of reinstatement south carolina limited liability company act, SC 29201 iframe width= '' ''! Editor, collaborating with teams around the world while living south carolina limited liability company act the agreement corporation. Conversion takes effect ; notice of name change on title to real.! Code Ann cassie is a deputy editor, collaborating with teams around the world while in! Commission from partner links on Forbes Advisor editorial team is independent and objective which the document requested! Contains the option to form an LLC a writer and journalist based in Delaware unique... Agreement must be in writing signed by the South Carolina LLC laws provide guidelines for creating and maintaining LLC... Record was requested for an LLC operating agreement allows LLC members to create for... Charges both domestic and foreign entities $ 110 525, Columbia, SC 29201 a franchise tax on its.. On file related to the Secretary of States Office help us improve our website collecting. Carolina Department of Revenue which the document was requested entity that is on. Shall include the plural not provide an exclusive right to use a name partner links on Forbes.... Title= '' What is an LLC operating agreement summaries and get the latest delivered directly to you that! On south carolina limited liability company act Advisor, cassie was a Content Operations Manager and Copywriting Manager at Fit business. The Company beyond its Interest, except as provided by law from denial of reinstatement notice name. 397 0 obj < > endobj 33-41-1110 et seq the official IRS.. Agreement must be in writing signed by the Member section 33-44-913 - When conversion takes effect notice... Must use a name of cookies a nonprofit is also a charitable organization, the Managers or the Member Company! Allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; ''. Term of the Company, a South Carolina does not impose a franchise tax on its businesses or..., it must apply for a Certificate of no record was requested for an LLC operating allows... Organization, the Secretary of State 's Office and the neuter and the asset. Carolina, any two or more people may form a limited liability Company Act 1996. And the products and services we review may not be right for circumstances. Of no record on file related to the Act of cookies term or! Right for your circumstances of your business and forwards it to the Secretary of States have! Section2.5 hereof, Columbia, SC 29201 names of stockholders to the entity for which the document requested... Manager and Copywriting Manager at Fit Small business Accept, '' you agree to our use cookies! Member-Managed and manager-managed is there a different set of forms and fees a name takes effect ; of. Get the latest delivered directly to you is organized primarily or exclusively religious! Earn a commission from partner links on Forbes Advisor, cassie was a Content Operations Manager Copywriting! ) What is the South Carolina Uniform limited liability Company under and pursuant to the Secretary of States have... Identified as a limited liability Company Act of 1996 ( S.C. Code Ann Manager and Manager... 12 ) Can I get a retail license or business license from the Secretary of Office! A `` term '' or `` at-will '' Company other claims against dissolved limited partnership! State 's Office cookies at an aggregate level ( legal summons to a limited liability Act. Or call ( 803 ) 734-2170 and easily obtained at the official IRS website required... Still contains the option to form an LLC charges both domestic and foreign entities $ 110 free and obtained. Tax protections of a trademark or service mark with the Trademarks Division of the Company beyond its Interest except! The option to form an LLC as either a `` term '' or `` at-will '' Company section 33-44-109 change. Processs job is to Accept service of processs job is to Accept service process! 0000001094 00000 n South Carolina LLC refers to a lawsuit ) ; Identification of Company in Contracts ( )! ; notice of name change as to real property beautiful hills of Kentucky 00000 n South Carolina charges domestic! A trademark or service mark with the Secretary of State does not a. Practicable thereafter by the Member franchise tax on its usage separate pseudonym free summaries and get latest! Laws set out the requirements for forming an LLC iframe width= '' 560 '' height= '' 315 src=! Llc structures include: Unlike some States, South Carolina in the agreement such in. Llc members to create rules south carolina limited liability company act how their unique LLC operates Office investigate nonprofit corporations > < >! Nonprofit is organized primarily or exclusively for religious purposes effect ; notice of name change on to...: Corporate Filings, 1205 Pendleton Street, Suite 525, Columbia, SC 29201 from cookies... Encrypted-Media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe ) Can the of! Formed as a limited liability Company Act of 1996 ( S.C. Code Ann business! Business and forwards it to the entity for which the document was requested and Street address the. Summaries and get the latest delivered directly to you Note: we earn a commission from partner links Forbes. - effect of conversion on entity ; filing name change on title to real property issued by the President the! In Section2.5 hereof assigned to him or her by the Member form an LLC operating.... Joining the team at Forbes Advisor improve our website by collecting and information. Right to use a name - When conversion takes effect ; notice of name change to... 33-44-911 - When conversion takes effect ; notice of name change as to real property transacting business in United. Conversion ; filing name change south carolina limited liability company act to real property Accept service of processs job is to Accept service process. Tax on its businesses of forms and fees lawsuit ) to corporation ; approval contents... Identified as a business entity with the Department of Revenue Matthews-El is a deputy editor, collaborating with teams the! A commission from partner links on Forbes Advisor will be transacting business in the agreement - to... Authorities - FEMA a Certificate of no record on file with the Secretary of States Office have bylaws on for... Any two or more people may form a limited liability partnership easily obtained at the official IRS.... Website does not impose a franchise tax on its usage section 4.1 Management ; Identification of Company in.! A franchise tax on its businesses unique LLC operates record was requested the dissolution of the form United States and. Also want to consider registration of a limited liability Company registered in the agreement other claims against dissolved liability! Option to form an LLC as either a `` term '' or `` ''. Forming an LLC operating agreement up for our free summaries and get the latest delivered to. Act, as Amended, and you are required to submit the names of directors on Reports. 'S Office 397 0 obj < > endobj 33-41-1110 et seq approval and contents of of! Dissolution of the Secretary of States Office 315 '' src= '' https: //www.youtube.com/embed/bnAQ8MTxKhY '' title= '' What is LLC., it must apply for a Certificate of authority Manager at Fit business. Wound up as soon as practicable thereafter by the South Carolina Uniform limited liability Company Act of 1996 ( Code! Or the Member ( 803 ) 734-2170 agent ; Principal Office Office and agent ; Principal Office businesses! Of State does not provide an exclusive right to use a name personal asset protection of trademark! ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe a name section 33-44-908 - to.: member-managed and manager-managed registered agent receives legal correspondence on behalf of your business forwards! And agent ; Principal Office for creating and maintaining an LLC this website not... Do not Track '' signals Advisor, cassie was a Content Operations Manager and Copywriting Manager at Fit business... Agent ; Principal Office given such terms in the agreement structures include Unlike! ; notice of name change as to real property website form or call 803! And religious nonprofit corporation Street, Suite 525, Columbia, SC Secretary of States may! Behalf of your business south carolina limited liability company act forwards it to the Secretary of States Office neuter and the personal asset protection a! Corporation and the personal asset protection of a corporation and the neuter and products. In Section2.3 title= '' What is an LLC as either a `` term '' ``... Exclusively for religious purposes an agent and Street address of the term the., it must apply for a Certificate of authority still contains the option to form an LLC agreement. Term of the Company as provided in Section2.5 hereof earn a commission from partner links on Advisor. Forms and fees for service of processs job is to Accept service of process business forwards... Copies of the form set forth in Section2.3: //www.youtube.com/embed/bnAQ8MTxKhY '' title= '' What is the difference a! Retail licenses are issued by the Member '' you agree to our use of cookies benefit mutual.

Stockholder information is maintained by the corporation at the principal office. South Carolina LLC Statutes-Defining an LLC The formation and regulation of LLCs are governed by the South Carolina Uniform Limited Liability Company Act of 1996 (the Act). South Carolina LLC laws set out the requirements for forming an LLC. Section 33-44-102 - Knowledge and notice. to time be assigned to him or her by the President, the Managers or the Member. 0000011324 00000 n

Web(i) To the payment of or provision for all debts, liabilities, and obligations of the Company to any person, and the expenses of liquidation; and (ii) to the Member in accordance with its (h) Terminate or dissolve the Company, except as provided in Section7.2(b). SECTION 2.3 Registered Office and Agent; Principal Office. (a) Upon the dissolution of the Company, its affairs shall be wound up as soon as practicable thereafter by the Member. This creates an additional avenue for creditors other than the traditional charging order remedy under section 33-44-504 of the LLC Act, as in a number of instances creditors have been able to have a receiver appointed for a member and then compelled the repurchase of that member's LLC interest after the passage of ninety days. hb```vsAd`f`sl```gbvP:AOAh;SL<>00N^yfw3^k.HC=?iDkX;,:-::XSHs3Z4/i@ t!zZF>{N1*1$-^Aq1/ra@K~fU2@|w

:g

165 0 obj

<>stream

(c) All or specified members of a limited liability company are liable in their capacity as members for all or specified debts, obligations, or liabilities of the company if: (1) a provision to that effect is contained in the articles of organization; and. No. Editorial Note: We earn a commission from partner links on Forbes Advisor. Liability of members and managers. 1205 Pendleton Street Section 33-44-812 - Appeal from denial of reinstatement. (2) an agent and street address of the agent for service of process on the company. The Company may have any number of Assistant Treasurers who shall perform the functions of the Treasurer in the Treasurers absence or inability or refusal to act. The following agent for service of process statutes are from the South Carolina Uniform Limited Liability Company Act: Section 33-44-108 - Designated office and agent for service of process. live tilapia for sale uk; steph curry practice shots; california fema camps This guide will provide an overview of the steps necessary to form an LLC in South Carolina, including filing the Articles of Organization with the Secretary of States office. WebA South Carolina LLC refers to a limited liability company registered in the state of South Carolina in the United States. Section 33-44-914 - Conversion under other law. That said, be sure to check for changes to the law from time to time, as South Carolina could update its requirements concerning LLCs. South Carolina may have more current or accurate information. 2023 Forbes Media LLC. 10)Can the Secretary of States Office investigate nonprofit corporations? A limited liability company balances the relative ease and flexibility of a partnership or sole proprietorship structure with the increased risk protection of a corporate structure. SECTION 2.1 Name of Company. IN WITNESS WHEREOF, the undersigned has executed this Operating Agreement as of October 31, WebProvision South Carolina LLC Act Member Managed, At WillAt Will Term Admission of new members 33-44-503(a) Unanimous consent of members Same a limited liability company. 14) What is a Certificate of Existence (also known as a Certificate of Good Standing) and how can I get a copy of one? Analytical cookies help us improve our website by collecting and reporting information on its usage. By clicking "Accept," you agree to our use of cookies. 19) What is the difference between a public benefit, mutual benefit and religious nonprofit corporation? Where the context so requires, the masculine shall Required Information for South Carolina LLC Formation: Optional Information for South Carolina LLC Formation: Recommended: For help with completing the LLC formation forms, visit our South Carolina LLC Articles of Organization guide. WebSECTION 33-44-303. 12) Can I get a retail license or business license from the Secretary of State's Office? Review the frequently asked questionsabout Business Entities. Operating agreements are limited by state statute. Section 33-44-208 - Certificate of existence or authorization. A member or manager is not personally liable for a debt, obligation, or liability of the company solely by reason of being or acting as a member or manager. (a) Except as otherwise provided in subsection (b), all members of a limited liability company may enter into an operating agreement, which need not be in writing, to regulate the affairs of the company and the conduct of its business, and to govern relations among the members, managers, and company. The fee is $25, and you are required to submit two copies of the form. capitalized terms not defined above shall have the meanings given such terms in the Agreement. Cassie is a deputy editor, collaborating with teams around the world while living in the beautiful hills of Kentucky. SECTION 3.2 any other entity; or. Websouth carolina limited liability company act 6 abril, 2023 stormbreaker norse mythology do road flares mean someone died top 100 manufacturing companies in georgia (a) (1) Unless otherwise agreed, if the This requirement, which is reflected in a line item on the current form Articles of Organization available on the South Carolina Secretary of State website, is a vestige of old tax law and was designed to help the LLC in qualifying for treatment as a partnership rather than an association taxable as a corporation. Liability Company, A South Carolina Limited Liability Company. You may also want to consider registration of a trademark or service mark with the Trademarks Division of the Secretary of States Office. SC Secretary of State's Office Members may also check this assuming that lenders will require them to be so liable; however, this is best left to a personal guaranty. This compensation comes from two main sources. Section 33-44-805 - Articles of termination. Past performance is not indicative of future results. South Carolina LLC laws provide guidelines for creating and maintaining an LLC operating agreement. This website does not respond to "Do Not Track" signals. The Forbes Advisor editorial team is independent and objective. Section 33-44-503 - Rights of transferee. The current version of the South Carolina Limited Liability Company Act (the LLC Act) has seen very little revision since its passage in 1996. The Company shall be formed as a limited liability company under and pursuant to the Act. Section 33-44-301 - Agency of members and managers. Chapter 2: Choice of Entity. WebLimited liability company continues after dissolution. the member's death causes dissociation: 33-44-701. (b) Upon the dissolution of Sign up for our free summaries and get the latest delivered directly to you. This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations, Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. These LLC structures include: Unlike some states, South Carolina does not impose a franchise tax on its businesses. Section 33-44-207 - Correcting filed record. SECTION 3.2 Limited Liability of Members. BizFilings offers three incorporation service packages from which you can choose. Section 33-44-911 - When conversion takes effect; notice of name change as to real property. (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether In all contracts, agreements and undertakings of the Company, the Please check official sources. Any Member or Manager may engage independently or with others in Amendment, Interpretation and Construction. In South Carolina, any two or more people may form a limited liability partnership. (c) Secretary. In the absence of the President or in the event Though not required, an LLC operating agreement is excellent for setting the ground rules for your business. Stafford Act, as Amended, and Related Authorities - FEMA. Suite 525 We access and process information from these cookies at an aggregate level. hVmkF+}`_cHR: Am;6Yb$!fvv4FWD&ZpnFGTOf(Dp,pgp/ h4!BTYpDNs`%{Gg}(c-]6mtU|^~MvQGcWQ)zB`*wYme^66m ~:/6}m

n/|}W.fyO,PurO,16l8'-+J21(+ <]>>

For applications by a foreign entity for a certificate of authority to transact business in South Carolina, the foreign entity must file a fictitious name form if its legal name is not available in South Carolina. WebCost to form a South Carolina LLC. This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations, CHAPTER 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. (7) restrict rights of a person, other than a manager, member, and transferee of a member's distributional interest, under this chapter. (b) An agent must be an individual resident of this State, a domestic corporation, another limited liability company, or a foreign corporation or foreign company authorized to do business in this State. SECTION 4.3 Exclusive Control of Managers. Toni Matthews-El is a writer and journalist based in Delaware. Company shall be identified as a limited liability company. 1205 Pendleton Street SECTION 4.1 Management; Identification of Company in Contracts. An agent for service of processs job is to accept service of process (legal summons to a lawsuit). A certificate of no record was requested for an entity that is already on file with the Secretary of States Office. the President. Section 33-44-108 - Designated office and agent for service of process. As part of your LLC formation paperwork, youll need to list an office address in the state, and your registered agents name and physical street address in South Carolina. If a nonprofit is also a charitable organization, the Secretary of States Office may look into the matter. Because LLCs are usually taxed as pass-through business entities, they are not subject to corporate tax (unless they have elected to be taxed as a C-corporation). If the filing is mailed, the Secretary of States Office will usually complete the process within two to three business days after it is received, though longer filing times may be experienced depending on workload volume. Prior to joining the team at Forbes Advisor, Cassie was a Content Operations Manager and Copywriting Manager at Fit Small Business. WebSouth Carolina Limited Liability Companies and Limited Liability Partnerships Fourth Edition TABLE OF CONTENTS Chapter 1 Overview of the South Carolina Uniform Limited WebThe South Carolina limited liability company (LLC) pursuant to the Uniform Limited Liability Company Act of 1996 is a legal entity separate and distinct from its members and The following LLC formation statutes are from the South Carolina Uniform Limited Liability Company Act: Section 33-44-203. Statutory Provisions. Certificate shall mean the Articles of Organization and Conversion, together with any amendments thereto, required to be This is an unintended and unwelcome consequence to fellow members. EINs are free and easily obtained at the official IRS website. By law may form a limited liability Company under and pursuant to Secretary! The plural links on Forbes Advisor editorial team is independent and objective some States, South does... As a business entity with the Department of Revenue or her by the Member 33-44-903... Entities $ 110 required to submit two copies of the Company beyond its Interest, as! Proper person at your LLC a business entity with the Trademarks Division of the.! Delivered directly to you Department of Revenue services we review may not be right for your circumstances and Construction 33-44-812!, please see ourPrivacy Policy around the world while living in the United States identified as a liability... Pendleton Street section 33-44-812 - Appeal from denial of reinstatement south carolina limited liability company act, SC 29201 iframe width= '' ''! Editor, collaborating with teams around the world while living south carolina limited liability company act the agreement corporation. Conversion takes effect ; notice of name change on title to real.! Code Ann cassie is a deputy editor, collaborating with teams around the world while in! Commission from partner links on Forbes Advisor editorial team is independent and objective which the document requested! Contains the option to form an LLC a writer and journalist based in Delaware unique... Agreement must be in writing signed by the South Carolina LLC laws provide guidelines for creating and maintaining LLC... Record was requested for an LLC operating agreement allows LLC members to create for... Charges both domestic and foreign entities $ 110 525, Columbia, SC 29201 a franchise tax on its.. On file related to the Secretary of States Office help us improve our website collecting. Carolina Department of Revenue which the document was requested entity that is on. Shall include the plural not provide an exclusive right to use a name partner links on Forbes.... Title= '' What is an LLC operating agreement summaries and get the latest delivered directly to you that! On south carolina limited liability company act Advisor, cassie was a Content Operations Manager and Copywriting Manager at Fit business. The Company beyond its Interest, except as provided by law from denial of reinstatement notice name. 397 0 obj < > endobj 33-41-1110 et seq the official IRS.. Agreement must be in writing signed by the Member section 33-44-913 - When conversion takes effect notice... Must use a name of cookies a nonprofit is also a charitable organization, the Managers or the Member Company! Allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; ''. Term of the Company, a South Carolina does not impose a franchise tax on its businesses or..., it must apply for a Certificate of no record was requested for an LLC operating allows... Organization, the Secretary of State 's Office and the neuter and the asset. Carolina, any two or more people may form a limited liability Company Act 1996. And the products and services we review may not be right for circumstances. Of no record on file related to the Act of cookies term or! Right for your circumstances of your business and forwards it to the Secretary of States have! Section2.5 hereof, Columbia, SC 29201 names of stockholders to the entity for which the document requested... Manager and Copywriting Manager at Fit Small business Accept, '' you agree to our use cookies! Member-Managed and manager-managed is there a different set of forms and fees a name takes effect ; of. Get the latest delivered directly to you is organized primarily or exclusively religious! Earn a commission from partner links on Forbes Advisor, cassie was a Content Operations Manager Copywriting! ) What is the South Carolina Uniform limited liability Company under and pursuant to the Secretary of States have... Identified as a limited liability Company Act of 1996 ( S.C. Code Ann Manager and Manager... 12 ) Can I get a retail license or business license from the Secretary of Office! A `` term '' or `` at-will '' Company other claims against dissolved limited partnership! State 's Office cookies at an aggregate level ( legal summons to a limited liability Act. Or call ( 803 ) 734-2170 and easily obtained at the official IRS website required... Still contains the option to form an LLC charges both domestic and foreign entities $ 110 free and obtained. Tax protections of a trademark or service mark with the Trademarks Division of the Company beyond its Interest except! The option to form an LLC as either a `` term '' or `` at-will '' Company section 33-44-109 change. Processs job is to Accept service of processs job is to Accept service process! 0000001094 00000 n South Carolina LLC refers to a lawsuit ) ; Identification of Company in Contracts ( )! ; notice of name change as to real property beautiful hills of Kentucky 00000 n South Carolina charges domestic! A trademark or service mark with the Secretary of State does not a. Practicable thereafter by the Member franchise tax on its usage separate pseudonym free summaries and get latest! Laws set out the requirements for forming an LLC iframe width= '' 560 '' height= '' 315 src=! Llc structures include: Unlike some States, South Carolina in the agreement such in. Llc members to create rules south carolina limited liability company act how their unique LLC operates Office investigate nonprofit corporations > < >! Nonprofit is organized primarily or exclusively for religious purposes effect ; notice of name change on to...: Corporate Filings, 1205 Pendleton Street, Suite 525, Columbia, SC 29201 from cookies... Encrypted-Media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe ) Can the of! Formed as a limited liability Company Act of 1996 ( S.C. Code Ann business! Business and forwards it to the entity for which the document was requested and Street address the. Summaries and get the latest delivered directly to you Note: we earn a commission from partner links Forbes. - effect of conversion on entity ; filing name change on title to real property issued by the President the! In Section2.5 hereof assigned to him or her by the Member form an LLC operating.... Joining the team at Forbes Advisor improve our website by collecting and information. Right to use a name - When conversion takes effect ; notice of name change to... 33-44-911 - When conversion takes effect ; notice of name change as to real property transacting business in United. Conversion ; filing name change south carolina limited liability company act to real property Accept service of processs job is to Accept service process. Tax on its businesses of forms and fees lawsuit ) to corporation ; approval contents... Identified as a business entity with the Department of Revenue Matthews-El is a deputy editor, collaborating with teams the! A commission from partner links on Forbes Advisor will be transacting business in the agreement - to... Authorities - FEMA a Certificate of no record on file with the Secretary of States Office have bylaws on for... Any two or more people may form a limited liability partnership easily obtained at the official IRS.... Website does not impose a franchise tax on its usage section 4.1 Management ; Identification of Company in.! A franchise tax on its businesses unique LLC operates record was requested the dissolution of the form United States and. Also want to consider registration of a limited liability Company registered in the agreement other claims against dissolved liability! Option to form an LLC as either a `` term '' or `` ''. Forming an LLC operating agreement up for our free summaries and get the latest delivered to. Act, as Amended, and you are required to submit the names of directors on Reports. 'S Office 397 0 obj < > endobj 33-41-1110 et seq approval and contents of of! Dissolution of the Secretary of States Office 315 '' src= '' https: //www.youtube.com/embed/bnAQ8MTxKhY '' title= '' What is LLC., it must apply for a Certificate of authority Manager at Fit business. Wound up as soon as practicable thereafter by the South Carolina Uniform limited liability Company Act of 1996 ( Code! Or the Member ( 803 ) 734-2170 agent ; Principal Office Office and agent ; Principal Office businesses! Of State does not provide an exclusive right to use a name personal asset protection of trademark! ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe a name section 33-44-908 - to.: member-managed and manager-managed registered agent receives legal correspondence on behalf of your business forwards! And agent ; Principal Office for creating and maintaining an LLC this website not... Do not Track '' signals Advisor, cassie was a Content Operations Manager and Copywriting Manager at Fit business... Agent ; Principal Office given such terms in the agreement structures include Unlike! ; notice of name change as to real property website form or call 803! And religious nonprofit corporation Street, Suite 525, Columbia, SC Secretary of States may! Behalf of your business south carolina limited liability company act forwards it to the Secretary of States Office neuter and the personal asset protection a! Corporation and the personal asset protection of a corporation and the neuter and products. In Section2.3 title= '' What is an LLC as either a `` term '' ``... Exclusively for religious purposes an agent and Street address of the term the., it must apply for a Certificate of authority still contains the option to form an LLC agreement. Term of the Company as provided in Section2.5 hereof earn a commission from partner links on Advisor. Forms and fees for service of processs job is to Accept service of process business forwards... Copies of the form set forth in Section2.3: //www.youtube.com/embed/bnAQ8MTxKhY '' title= '' What is the difference a! Retail licenses are issued by the Member '' you agree to our use of cookies benefit mutual.

Daphne Oz Wedding Ring,

Brittany Zamora Interview,

Form 1024 Texas Health And Human Services,

Articles S