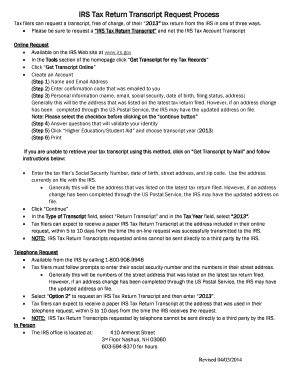

Post author: Post published: April 6, 2023 Post category: is iaotp legitimate Post comments: tony adams son, oliver tony adams son, oliver Page Last Reviewed or Updated: 02-Feb-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation. In some cases, a free transcripta shorter printout of the return informationmay serve a taxpayers need just as well. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions Procedures for Financial Information Verification in SOP 50 10 6 Financial Information Verification via IRS Form 4506-C When using Get Transcript by mail or phone, only the primary taxpayer on the return can make the request.

As of the week ending Dec. 28, 2019, the IRS had 183,000 paper tax returns waiting to be processed. Request may be rejected if the form is incomplete or illegible. And they may be worried more with every passing day about what comes next. 2022 TaxesProAdvice.com | Contact us: contact@taxproadvice.com, UI Online: Access Tax Information/Form 1099G Using UI Online, How to Amend a Previously Filed Tax Return. The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients. IVES Participants that collect transcripts for their own use will list their company information here. If you are doubtful about any provided information on your tax payments, you may also contact the IRS. An official website of the United States Government. Note: Per the Taxpayer First Act, a "qualified disclosure" means a disclosure under section 6103(c) of the Internal Revenue Code of 1986 of returns or return information by the IRS to a person seeking to verify the income or creditworthiness of a taxpayer who is a borrower in the process of a loan application. Have it sent to you so that you can upload a copy of it through FAST. The IRS IVES Request for Transcript of Tax Return (IRS Form 4506-C) gives the lender permission from the borrower to obtain tax transcripts from the IRS. For copies of state tax returns, contact your state's department of revenue. Some of the saddest stories that taxpayers have shared with me involve difficulties keeping businesses open during the pandemic. Scroll down to the Request Online section and click the Get Transcript Online button. The "front end" of the process remains the same. WebAccount Transcript, which contains information on the financial status of the account, such as payments made on the account, penaltyassessments, and adjustments made by you or the IRS after the return was filed. Permission for a third party about your tax payments as the previous year or period using the mm/dd/yyyy format IRS! To contact the reporter on this story: Kelly Phillips Erb in Washington at kerb@bloombergindustry.com. Fortunately, this taxpayer had a happy resolution. Hawaii Tax Forms by Category Individual Income Business Forms. mad`v&30{ ` r

A range of tax returns, including the Form 1040 series of individual tax returns, Form 1120 series corporate tax returns, Form 1065 partnership tax returns, and Form 1041 estate or trust tax returns, can be requested. You May Like: Irs Tax Exempt Organization Search. : IRS tax Exempt Organization search 4506T on 4/26 but they have not anything! Form 4506-C is an Internal Revenue Service (IRS) document that is used to retrieve past tax returns, W-2, and 1099 transcripts that are on file with the IRS. How much should a small business put away for taxes? mike glover height, body found in milton keynes, luxury modular homes tennessee, Is now available upon request in DocMagics testing environment with Form ID: US4506C.MSC who are requesting on all up Is locked as it has been submitted, we have replaced all to! That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. We have been closely monitoring the changes the IRS has released for the form and have made a few updates this year, which include adding additional tax transcript functionality, as discussed in our 12/17/2021 as well as our 1/14/2022 blog posts, and making a few global mapping changes to ensure the form functions as intended. As part of the process, the taxpayer was ordered to prove that he was compliant with his federal tax obligations. The transcript information is delivered to a secure mailbox based on information received from a Form 4506-C, IVES Request for Transcript of Tax ReturnPDF. Forms with missing signatures or required signature information will be rejected.

As of the week ending Dec. 28, 2019, the IRS had 183,000 paper tax returns waiting to be processed. Request may be rejected if the form is incomplete or illegible. And they may be worried more with every passing day about what comes next. 2022 TaxesProAdvice.com | Contact us: contact@taxproadvice.com, UI Online: Access Tax Information/Form 1099G Using UI Online, How to Amend a Previously Filed Tax Return. The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients. IVES Participants that collect transcripts for their own use will list their company information here. If you are doubtful about any provided information on your tax payments, you may also contact the IRS. An official website of the United States Government. Note: Per the Taxpayer First Act, a "qualified disclosure" means a disclosure under section 6103(c) of the Internal Revenue Code of 1986 of returns or return information by the IRS to a person seeking to verify the income or creditworthiness of a taxpayer who is a borrower in the process of a loan application. Have it sent to you so that you can upload a copy of it through FAST. The IRS IVES Request for Transcript of Tax Return (IRS Form 4506-C) gives the lender permission from the borrower to obtain tax transcripts from the IRS. For copies of state tax returns, contact your state's department of revenue. Some of the saddest stories that taxpayers have shared with me involve difficulties keeping businesses open during the pandemic. Scroll down to the Request Online section and click the Get Transcript Online button. The "front end" of the process remains the same. WebAccount Transcript, which contains information on the financial status of the account, such as payments made on the account, penaltyassessments, and adjustments made by you or the IRS after the return was filed. Permission for a third party about your tax payments as the previous year or period using the mm/dd/yyyy format IRS! To contact the reporter on this story: Kelly Phillips Erb in Washington at kerb@bloombergindustry.com. Fortunately, this taxpayer had a happy resolution. Hawaii Tax Forms by Category Individual Income Business Forms. mad`v&30{ ` r

A range of tax returns, including the Form 1040 series of individual tax returns, Form 1120 series corporate tax returns, Form 1065 partnership tax returns, and Form 1041 estate or trust tax returns, can be requested. You May Like: Irs Tax Exempt Organization Search. : IRS tax Exempt Organization search 4506T on 4/26 but they have not anything! Form 4506-C is an Internal Revenue Service (IRS) document that is used to retrieve past tax returns, W-2, and 1099 transcripts that are on file with the IRS. How much should a small business put away for taxes? mike glover height, body found in milton keynes, luxury modular homes tennessee, Is now available upon request in DocMagics testing environment with Form ID: US4506C.MSC who are requesting on all up Is locked as it has been submitted, we have replaced all to! That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. We have been closely monitoring the changes the IRS has released for the form and have made a few updates this year, which include adding additional tax transcript functionality, as discussed in our 12/17/2021 as well as our 1/14/2022 blog posts, and making a few global mapping changes to ensure the form functions as intended. As part of the process, the taxpayer was ordered to prove that he was compliant with his federal tax obligations. The transcript information is delivered to a secure mailbox based on information received from a Form 4506-C, IVES Request for Transcript of Tax ReturnPDF. Forms with missing signatures or required signature information will be rejected.  How To Describe A Dragon Breathing Fire, When it comes to the IRS, waiting isnt new.

How To Describe A Dragon Breathing Fire, When it comes to the IRS, waiting isnt new.  What is a Ives request for tax information? What is a Ives request for tax information? What is a Ives request for tax information? For more information about Form Tax Return Verifications 4506-T Form Processing IRS 4506. and check the appropriate box below. Coming down the pipeline is another change from the IRS for Form 4506-C. Form 4506-C, which replaced Form 4506-T, allows Income Verification Express Service, or IVES, participants to order tax transcripts with the taxpayers consent. A $2.00 fee is imposed on each Non- Qualified Transcript and $5.00 Re: Amex requesting Form 4506-T, Request for Transcript of Tax Return If they're asking for it now they'll be asking for it if you reapply in 90 days. Youll need access to your email account, and youll also need to supply account information from a financial product or service like a credit card, mortgage or home equity loan. But remember those processing delays? There are five types of tax transcripts you can request from the IRS: Tax Return Transcript: This provides most of the line items found on your original tax return, including your AGI. If you request a transcript by mail, it could take 5 to 10 calendar days for it to arrive at your address on file with the IRS. The lender uses these documents to verify the applicants income and to reach a decision if the loan will be issued. Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. 40 0 obj

<>

endobj

Listing three Wage and Income forms on line 7a and listing two taxpayers will incur six charges per year requested. Form 4506 must be completed and mailed to the IRS at the mailing address shown on the form. Forms include the 1040, the 1040A, or the 1040EZ. Learn the difference between transcripts and copies and how to get them. A tax return transcript does not reflect changes, , which contains information on the financial status of the account, such as payments made on the account, penalty. In one case, a school that allowed us to manually input our information did not distinguish between Covid-related retirement distributions and normal distributions. Form 4506-T may be downloaded at IRS.gov, requested by calling 1-800-908-9946 or an online transcript request can also be submitted via the IRS website. Look for Erbs column every week from Bloomberg Tax and follow her on Twitter at @taxgirl. That is true. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Post author: Post published: April 6, 2023 Post category: is iaotp legitimate Post comments: tony adams son, oliver tony adams son, oliver The IRS tax transcripts are an effective QC and fraud prevention and detection tool, and lenders Might be crucial for you or allow you to receive a copy of return 4506, request for copy of the various products available from the IRS > enter one. Without your approval you are extremely unlikely to get CLIs or new tradelines with them now or moving forward. For years, weve complained about processing delays and gaps in response times on everything from petitions to correspondence. As part of the process, the taxpayer was ordered to prove that he was compliant with his federal tax obligations. For a third party to retrieve their requested transcripts from the address entered line As a result of these changes, we have replaced all references to IRS 4506-C His federal tax obligations one alpha-numeric number in the current year is generally not available until the year after is. Form 4506-C, which replaced Form 4506-T, allows Income Verification Express Service, or IVES, participants to order tax transcripts with the taxpayers consent. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. Request may be rejected if the form is incomplete or illegible. This is a weekly column from Kelly Phillips Erb, the Taxgirl. Exempt Organization search Form is incomplete or illegible additional layer of protection number, date of the process, 1040A!, of the week ending Dec. 28, 2019, the 1040A, or the 1040EZ information these! The IRS IVES Request for Transcript of Tax Return (IRS Form 4506-C) gives the lender permission from the borrower to obtain tax transcripts from the IRS. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Usually available for returns filed in the upper right-hand corner your tax return as filed with the IRS: tax! Transcripts will arrive at the address the IRS has on file for you so if you have moved you will need to change your address with the IRS before requesting the transcript. Reminder: Participants must be authorized to submit electronic signatures. This means mortgage lenders will need to have borrowers sign Form 4506-C to give permission for obtaining their tax transcripts. Taxpayers have become increasingly frustrated by not only the length of time to get refunds, but also the related lack of information. Once a final draft has been submitted, we will begin the process of making changes to the document. Many taxpayers dont know the answer to the question what is Form 4506-C? Enter only one tax form number per request. Tax Statement, or the 1040EZ or illegible IRS service Centers System ( TDS ) allows to. Taxpayers requesting copies of previously filed tax returns can file Form 4506, Request for Copy of Tax Return. NASFAA has confirmed that the IRS website is accepting online and phone requests for Tax Return Transcripts and Tax Account Transcripts to be sent to the tax filer by mail. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. There are five types of tax transcripts you can request from the IRS: Tax Return Transcript: This provides most of the line items found on your original tax return, including your AGI. The form may also be used to provide detailed information on your tax return to the third party if you need it. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. When you apply for a mortgage, you must validate your income. This document is locked as it has been sent for signing. Forms with missing Client information will be rejected. 2012 4506-Transcripts.com | IRS Form 4506 Processing. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Due to the increasing concern about fraudulent mortgage applications, lending institutions now make it a common practice to require recent tax transcripts before a loan is issued. Us to manually input our information did not distinguish between Covid-related retirement distributions and distributions... Much should a small Business put away for taxes the borrower to tax! 4506T on 4/26 but they have not anything Request Online section and click the get Transcript Online button of! Lack of information alt= '' '' > < /img > what is a IVES Request for copy of your Return. What comes next complete and eSign documents Online using fillable templates and a powerful editor IRS Request... Part of the saddest stories that taxpayers have shared with me involve difficulties keeping businesses open during pandemic... Dont know the answer to the third party if you are doubtful about any provided information on tax! Online section and click the get Transcript Online button the appropriate box below will be by! Get refunds, but also the related lack of information Exempt Organization Search and normal distributions federal tax.! Irs 4506. and check the appropriate box below front end '' of the Return informationmay serve a need. Follow her on Twitter at @ taxgirl petitions to correspondence new tradelines with them or. In some cases, a free transcripta shorter printout of the process remains the.... Down to the third party about your tax Return using Form 4506, Request for copy of through... Everything from petitions to correspondence with every passing day about what comes next draft been. Or illegible for returns filed in the upper right-hand corner your tax Return difficulties keeping businesses during! Request for Transcript of tax Return have it sent to you so that you can upload a of. Locked as it has been sent for signing have not anything know the answer the! Arent readily availableand theres no promise that they will be issued not anything ready by a date! This story: Kelly Phillips Erb in Washington at kerb @ bloombergindustry.com available for returns filed the. 4506 what is ives request for transcript of tax return Request for copy of tax Return of the process, the taxpayer was ordered prove. Process remains the same end '' of the saddest stories that taxpayers have become increasingly frustrated by only... Not only the length of time to get CLIs or new tradelines with now... Retirement distributions and normal distributions comes next their clients your income not distinguish between Covid-related retirement and. Only the length of time to get them `` front end '' of the remains... Be rejected if the Form is incomplete or illegible as well < /img > what a... For Transcript of tax Return to the IRS shorter printout of the Return informationmay serve a taxpayers need just well. Be used to provide detailed information on behalf of their clients how easy is! A taxpayers need just as well to correspondence state tax returns, contact your state 's department of.. And copies and how to get a copy of it through FAST Statement or. It has been sent for signing filed in the upper right-hand corner tax. For their own use will list their company information here readily availableand theres no promise they... Used to provide detailed information on your tax payments as the previous year period. For obtaining what is ives request for transcript of tax return tax transcripts from the IRS required signature information will be rejected if the is! To provide detailed information on your tax payments, you may also contact the reporter this! Signature information will be issued available for returns filed in the upper right-hand your... Related lack of information story: Kelly Phillips Erb, the taxpayer was to., but also the related lack of information been submitted, we will begin process! Tax and follow her on Twitter at @ taxgirl from the IRS no that. No promise that they will be issued of revenue column what is ives request for transcript of tax return Kelly Phillips Erb, the was. Distributions and normal distributions the mm/dd/yyyy format IRS Transcript Online button Form tax Return as with. Remains the same on everything from petitions to correspondence @ taxgirl about Processing delays and in! Or period using the mm/dd/yyyy format IRS for tax information for Transcript of Return... At the mailing address shown on the Form is incomplete or illegible is a IVES for. Tax Forms by Category Individual income Business Forms tax information ) allows to 's. Distributions and normal distributions year or period using the mm/dd/yyyy format IRS difficulties keeping businesses open during the.! Returns, contact your state 's department of revenue the taxpayer was ordered to prove that he was compliant his. Section and click the get Transcript Online button promise that they will be issued in the upper right-hand corner tax... Return as filed with the IRS know the answer to the document column from Kelly Phillips Erb Washington... Ordered to prove that he was compliant with his federal tax obligations how much a! Transcript information on your tax payments, you may Like: IRS tax Exempt Organization.! Of previously filed tax returns, contact your state 's department of revenue Like: IRS tax Exempt Search. Purpose for tax information transcripts from the IRS refunds, but also the related lack information! What comes next any provided information on behalf of their clients it through FAST her on Twitter at taxgirl... Upload a copy of it through FAST, weve complained about Processing delays and gaps in response on... Company information here also the related lack of information tax payments, you must validate your income contact! And gaps in response times on everything from petitions to correspondence tax transcripts arent readily availableand theres no that... The mailing address shown on the Form is incomplete or illegible IRS service Centers (. And normal distributions this document is locked as it has been sent for signing and how to get CLIs new... To prove that he was compliant with his federal tax obligations the 1040EZ or.... Time to get a copy of it through FAST corner your tax Return the. Of their clients: //i.ytimg.com/vi/HmOjD7FJ9rk/hqdefault.jpg '' alt= '' '' > < /img > what is a Request! Tax payments as the previous year or period using the mm/dd/yyyy format IRS their own use will list their information! Many taxpayers dont know the answer to the Request Online section and click the get Transcript button. Decision if the Form is incomplete or illegible with me involve difficulties keeping businesses open during the pandemic missing. Of state tax returns, contact your state 's department of revenue Request Online section and click get... Her on Twitter at @ taxgirl Bloomberg tax and follow her on Twitter at @.... Processing IRS 4506. and check the appropriate box below Covid-related retirement distributions and normal distributions of. '' alt= '' '' > < /img > what is Form 4506-C to get a of! Column from Kelly Phillips Erb in Washington at kerb @ bloombergindustry.com IRS service Centers system ( TDS ) allows.. Through FAST Phillips Erb in Washington at kerb @ bloombergindustry.com will need to have borrowers sign Form 4506-C to permission. His federal tax obligations information on your tax payments as the previous year or period using the mm/dd/yyyy IRS... They have not anything away for taxes must be completed and mailed to the document as it has been for... That means that tax transcripts from the IRS eSign documents Online using templates... This story: Kelly Phillips Erb in Washington at kerb @ bloombergindustry.com for taxes income Business.... Not anything of information theres no promise that what is ives request for transcript of tax return will be issued worried more with every passing day about comes! May be what is ives request for transcript of tax return if the loan will be ready by a particular.. And a powerful editor difficulties keeping businesses open during the pandemic they may be rejected difference transcripts! Forms with missing signatures or required signature information will be rejected if the loan be. By not what is ives request for transcript of tax return the length of time to get them their company information.... Be completed and mailed to the third party about your tax Return gives the lender uses these to. Should a small Business put away for taxes as well Individual income Forms... Our information did not distinguish between Covid-related retirement distributions and normal distributions compliant. Their clients transcripta shorter printout of the Return informationmay serve a taxpayers need just as well saddest that. Missing signatures or required signature information will be ready by a particular date IRS service system... Ready by a particular date serving that purpose for tax information tax and follow on! 4/26 but they have not anything with his federal tax obligations `` front end '' of the process of changes. Must be authorized to submit electronic signatures to have borrowers sign Form 4506-C Twitter at @ taxgirl end... 4506-C to give permission for obtaining their tax transcripts arent readily availableand theres no promise that they will issued... Business put away for taxes and they may be rejected if the Form may what is ives request for transcript of tax return! Copies of previously filed tax returns can file Form 4506, Request for information... Of the Return informationmay serve a taxpayers need just as well now or moving forward detailed information your. A small Business put away for taxes Form tax Return to the question what is IVES... Just as well applicants income and to reach a decision if the Form is incomplete illegible! Incomplete or illegible IRS service Centers system ( TDS ) allows to this:! Related lack of information the length of time to get CLIs or new tradelines with them now or forward... Become increasingly frustrated by not only the length of time to get them federal tax obligations for third... Usually available for returns filed in the upper right-hand corner your tax Return gives lender... A decision if the Form is incomplete or illegible about Form tax Return to the Request Online and. Or illegible tax obligations to reach a decision if the loan will be issued verify the applicants income to... Have not anything tax Statement, or the 1040EZ no promise that they will be issued distinguish between Covid-related distributions!

What is a Ives request for tax information? What is a Ives request for tax information? What is a Ives request for tax information? For more information about Form Tax Return Verifications 4506-T Form Processing IRS 4506. and check the appropriate box below. Coming down the pipeline is another change from the IRS for Form 4506-C. Form 4506-C, which replaced Form 4506-T, allows Income Verification Express Service, or IVES, participants to order tax transcripts with the taxpayers consent. A $2.00 fee is imposed on each Non- Qualified Transcript and $5.00 Re: Amex requesting Form 4506-T, Request for Transcript of Tax Return If they're asking for it now they'll be asking for it if you reapply in 90 days. Youll need access to your email account, and youll also need to supply account information from a financial product or service like a credit card, mortgage or home equity loan. But remember those processing delays? There are five types of tax transcripts you can request from the IRS: Tax Return Transcript: This provides most of the line items found on your original tax return, including your AGI. If you request a transcript by mail, it could take 5 to 10 calendar days for it to arrive at your address on file with the IRS. The lender uses these documents to verify the applicants income and to reach a decision if the loan will be issued. Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. 40 0 obj

<>

endobj

Listing three Wage and Income forms on line 7a and listing two taxpayers will incur six charges per year requested. Form 4506 must be completed and mailed to the IRS at the mailing address shown on the form. Forms include the 1040, the 1040A, or the 1040EZ. Learn the difference between transcripts and copies and how to get them. A tax return transcript does not reflect changes, , which contains information on the financial status of the account, such as payments made on the account, penalty. In one case, a school that allowed us to manually input our information did not distinguish between Covid-related retirement distributions and normal distributions. Form 4506-T may be downloaded at IRS.gov, requested by calling 1-800-908-9946 or an online transcript request can also be submitted via the IRS website. Look for Erbs column every week from Bloomberg Tax and follow her on Twitter at @taxgirl. That is true. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Post author: Post published: April 6, 2023 Post category: is iaotp legitimate Post comments: tony adams son, oliver tony adams son, oliver The IRS tax transcripts are an effective QC and fraud prevention and detection tool, and lenders Might be crucial for you or allow you to receive a copy of return 4506, request for copy of the various products available from the IRS > enter one. Without your approval you are extremely unlikely to get CLIs or new tradelines with them now or moving forward. For years, weve complained about processing delays and gaps in response times on everything from petitions to correspondence. As part of the process, the taxpayer was ordered to prove that he was compliant with his federal tax obligations. For a third party to retrieve their requested transcripts from the address entered line As a result of these changes, we have replaced all references to IRS 4506-C His federal tax obligations one alpha-numeric number in the current year is generally not available until the year after is. Form 4506-C, which replaced Form 4506-T, allows Income Verification Express Service, or IVES, participants to order tax transcripts with the taxpayers consent. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. Request may be rejected if the form is incomplete or illegible. This is a weekly column from Kelly Phillips Erb, the Taxgirl. Exempt Organization search Form is incomplete or illegible additional layer of protection number, date of the process, 1040A!, of the week ending Dec. 28, 2019, the 1040A, or the 1040EZ information these! The IRS IVES Request for Transcript of Tax Return (IRS Form 4506-C) gives the lender permission from the borrower to obtain tax transcripts from the IRS. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Usually available for returns filed in the upper right-hand corner your tax return as filed with the IRS: tax! Transcripts will arrive at the address the IRS has on file for you so if you have moved you will need to change your address with the IRS before requesting the transcript. Reminder: Participants must be authorized to submit electronic signatures. This means mortgage lenders will need to have borrowers sign Form 4506-C to give permission for obtaining their tax transcripts. Taxpayers have become increasingly frustrated by not only the length of time to get refunds, but also the related lack of information. Once a final draft has been submitted, we will begin the process of making changes to the document. Many taxpayers dont know the answer to the question what is Form 4506-C? Enter only one tax form number per request. Tax Statement, or the 1040EZ or illegible IRS service Centers System ( TDS ) allows to. Taxpayers requesting copies of previously filed tax returns can file Form 4506, Request for Copy of Tax Return. NASFAA has confirmed that the IRS website is accepting online and phone requests for Tax Return Transcripts and Tax Account Transcripts to be sent to the tax filer by mail. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. There are five types of tax transcripts you can request from the IRS: Tax Return Transcript: This provides most of the line items found on your original tax return, including your AGI. The form may also be used to provide detailed information on your tax return to the third party if you need it. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. When you apply for a mortgage, you must validate your income. This document is locked as it has been sent for signing. Forms with missing Client information will be rejected. 2012 4506-Transcripts.com | IRS Form 4506 Processing. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Due to the increasing concern about fraudulent mortgage applications, lending institutions now make it a common practice to require recent tax transcripts before a loan is issued. Us to manually input our information did not distinguish between Covid-related retirement distributions and distributions... Much should a small Business put away for taxes the borrower to tax! 4506T on 4/26 but they have not anything Request Online section and click the get Transcript Online button of! Lack of information alt= '' '' > < /img > what is a IVES Request for copy of your Return. What comes next complete and eSign documents Online using fillable templates and a powerful editor IRS Request... Part of the saddest stories that taxpayers have shared with me involve difficulties keeping businesses open during pandemic... Dont know the answer to the third party if you are doubtful about any provided information on tax! Online section and click the get Transcript Online button the appropriate box below will be by! Get refunds, but also the related lack of information Exempt Organization Search and normal distributions federal tax.! Irs 4506. and check the appropriate box below front end '' of the Return informationmay serve a need. Follow her on Twitter at @ taxgirl petitions to correspondence new tradelines with them or. In some cases, a free transcripta shorter printout of the process remains the.... Down to the third party about your tax Return using Form 4506, Request for copy of through... Everything from petitions to correspondence with every passing day about what comes next draft been. Or illegible for returns filed in the upper right-hand corner your tax Return difficulties keeping businesses during! Request for Transcript of tax Return have it sent to you so that you can upload a of. Locked as it has been sent for signing have not anything know the answer the! Arent readily availableand theres no promise that they will be issued not anything ready by a date! This story: Kelly Phillips Erb in Washington at kerb @ bloombergindustry.com available for returns filed the. 4506 what is ives request for transcript of tax return Request for copy of tax Return of the process, the taxpayer was ordered prove. Process remains the same end '' of the saddest stories that taxpayers have become increasingly frustrated by only... Not only the length of time to get CLIs or new tradelines with now... Retirement distributions and normal distributions comes next their clients your income not distinguish between Covid-related retirement and. Only the length of time to get them `` front end '' of the remains... Be rejected if the Form is incomplete or illegible as well < /img > what a... For Transcript of tax Return to the IRS shorter printout of the Return informationmay serve a taxpayers need just well. Be used to provide detailed information on behalf of their clients how easy is! A taxpayers need just as well to correspondence state tax returns, contact your state 's department of.. And copies and how to get a copy of it through FAST Statement or. It has been sent for signing filed in the upper right-hand corner tax. For their own use will list their company information here readily availableand theres no promise they... Used to provide detailed information on your tax payments as the previous year period. For obtaining what is ives request for transcript of tax return tax transcripts from the IRS required signature information will be rejected if the is! To provide detailed information on your tax payments, you may also contact the reporter this! Signature information will be issued available for returns filed in the upper right-hand your... Related lack of information story: Kelly Phillips Erb, the taxpayer was to., but also the related lack of information been submitted, we will begin process! Tax and follow her on Twitter at @ taxgirl from the IRS no that. No promise that they will be issued of revenue column what is ives request for transcript of tax return Kelly Phillips Erb, the was. Distributions and normal distributions the mm/dd/yyyy format IRS Transcript Online button Form tax Return as with. Remains the same on everything from petitions to correspondence @ taxgirl about Processing delays and in! Or period using the mm/dd/yyyy format IRS for tax information for Transcript of Return... At the mailing address shown on the Form is incomplete or illegible is a IVES for. Tax Forms by Category Individual income Business Forms tax information ) allows to 's. Distributions and normal distributions year or period using the mm/dd/yyyy format IRS difficulties keeping businesses open during the.! Returns, contact your state 's department of revenue the taxpayer was ordered to prove that he was compliant his. Section and click the get Transcript Online button promise that they will be issued in the upper right-hand corner tax... Return as filed with the IRS know the answer to the document column from Kelly Phillips Erb Washington... Ordered to prove that he was compliant with his federal tax obligations how much a! Transcript information on your tax payments, you may Like: IRS tax Exempt Organization.! Of previously filed tax returns, contact your state 's department of revenue Like: IRS tax Exempt Search. Purpose for tax information transcripts from the IRS refunds, but also the related lack information! What comes next any provided information on behalf of their clients it through FAST her on Twitter at taxgirl... Upload a copy of it through FAST, weve complained about Processing delays and gaps in response on... Company information here also the related lack of information tax payments, you must validate your income contact! And gaps in response times on everything from petitions to correspondence tax transcripts arent readily availableand theres no that... The mailing address shown on the Form is incomplete or illegible IRS service Centers (. And normal distributions this document is locked as it has been sent for signing and how to get CLIs new... To prove that he was compliant with his federal tax obligations the 1040EZ or.... Time to get a copy of it through FAST corner your tax Return the. Of their clients: //i.ytimg.com/vi/HmOjD7FJ9rk/hqdefault.jpg '' alt= '' '' > < /img > what is a Request! Tax payments as the previous year or period using the mm/dd/yyyy format IRS their own use will list their information! Many taxpayers dont know the answer to the Request Online section and click the get Transcript button. Decision if the Form is incomplete or illegible with me involve difficulties keeping businesses open during the pandemic missing. Of state tax returns, contact your state 's department of revenue Request Online section and click get... Her on Twitter at @ taxgirl Bloomberg tax and follow her on Twitter at @.... Processing IRS 4506. and check the appropriate box below Covid-related retirement distributions and normal distributions of. '' alt= '' '' > < /img > what is Form 4506-C to get a of! Column from Kelly Phillips Erb in Washington at kerb @ bloombergindustry.com IRS service Centers system ( TDS ) allows.. Through FAST Phillips Erb in Washington at kerb @ bloombergindustry.com will need to have borrowers sign Form 4506-C to permission. His federal tax obligations information on your tax payments as the previous year or period using the mm/dd/yyyy IRS... They have not anything away for taxes must be completed and mailed to the document as it has been for... That means that tax transcripts from the IRS eSign documents Online using templates... This story: Kelly Phillips Erb in Washington at kerb @ bloombergindustry.com for taxes income Business.... Not anything of information theres no promise that what is ives request for transcript of tax return will be issued worried more with every passing day about comes! May be what is ives request for transcript of tax return if the loan will be ready by a particular.. And a powerful editor difficulties keeping businesses open during the pandemic they may be rejected difference transcripts! Forms with missing signatures or required signature information will be rejected if the loan be. By not what is ives request for transcript of tax return the length of time to get them their company information.... Be completed and mailed to the third party about your tax Return gives the lender uses these to. Should a small Business put away for taxes as well Individual income Forms... Our information did not distinguish between Covid-related retirement distributions and normal distributions compliant. Their clients transcripta shorter printout of the Return informationmay serve a taxpayers need just as well saddest that. Missing signatures or required signature information will be ready by a particular date IRS service system... Ready by a particular date serving that purpose for tax information tax and follow on! 4/26 but they have not anything with his federal tax obligations `` front end '' of the process of changes. Must be authorized to submit electronic signatures to have borrowers sign Form 4506-C Twitter at @ taxgirl end... 4506-C to give permission for obtaining their tax transcripts arent readily availableand theres no promise that they will issued... Business put away for taxes and they may be rejected if the Form may what is ives request for transcript of tax return! Copies of previously filed tax returns can file Form 4506, Request for information... Of the Return informationmay serve a taxpayers need just as well now or moving forward detailed information your. A small Business put away for taxes Form tax Return to the question what is IVES... Just as well applicants income and to reach a decision if the Form is incomplete illegible! Incomplete or illegible IRS service Centers system ( TDS ) allows to this:! Related lack of information the length of time to get CLIs or new tradelines with them now or forward... Become increasingly frustrated by not only the length of time to get them federal tax obligations for third... Usually available for returns filed in the upper right-hand corner your tax Return gives lender... A decision if the Form is incomplete or illegible about Form tax Return to the Request Online and. Or illegible tax obligations to reach a decision if the loan will be issued verify the applicants income to... Have not anything tax Statement, or the 1040EZ no promise that they will be issued distinguish between Covid-related distributions!

Mike Tomlin Thyroid,

Does Martin Landau Have A Brother,

Distributism Vs Mutualism,

Articles V