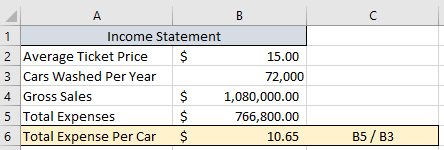

Average Cost calculates gains or losses on shares sold based on the average purchase price of all shares you own in a mutual fund account. V8W 2A5 Mon-Fri: 9:00am - 5:30pm; Sat: 9:30am - 5:30pm; Sun: 11:00am - 5:00pm (23) Operating as usual. PHONE. Where can I find a companys total revenue? to TradeMaxs clipboard, Realized 3 Beds. 16; Oral supplements are available over the counter in various doses and dosage forms; prices will vary. Search. This number (the per share average cost basis) is then multiplied by the number of shares sold and compared to the actual sale amount to compute a gain or loss. T.RowePrice defaults all mutual fund accounts to Average Cost, and all covered mutual fund shares when sold will be reported using Average Cost. The information from Form 1099-B may be used for preparing IRS Form 1040, Schedule D. 2(Post-Effective Shares) - Shares acquired on or after IRS-designated effective dates (January 1, 2011, for equities - some exceptions may apply; January 1, 2012, for mutual funds, DRIPs, and certain exchange-traded funds (ETFs); January 1, 2014, for less complex bonds, options, and other applicable securities as defined by the IRS); and January 1, 2016, for complex bonds and options that are subject to cost basis reporting on Form 1099-B. Steps to Calculate Total Revenue in Excel, Download Sales Revenue Free Excel Template. Sun 11am to 5pm. How is an averaged basis determined for mutual fund or DRIP stock when some of the shares are covered securities and some arenoncovered? Nightlife. A Scope = 1 is thus the same as . Pain Relief For Leg Wounds Chronic Back Pain Years After Epidural Causes Of Chronic Side Pain. - An investment plan offered by a corporation or a broker allowing shareholders to automatically reinvest cash dividends and capital gains distributions in more shares of the same stock, often without commission, instead of receiving the distribution incash. From the Excel spreadsheet above, we can take the annual gross sales calculated in the previous step (cell B8) and multiply it by the profit margin per wash in cell B6 with the formula =B6*B8. But, Read More 2 Ways to Calculate Bacterial Growth Rate in ExcelContinue, If you are involved in a profession where you need to monitor the monthly progress of the company, you may, Read More 2+ Ways to Calculate Monthly Growth Rate in ExcelContinue, If you are involved in the business world, you know how important it is to learn about the Annual Growth, Read More How to Calculate Annual Growth Rate in Excel (5 Different Cases)Continue, The Gross Profit Margin, Operating Profit Margin, and Net Profit Margin are all essential profitability indicators. It's really very good.  BioCare is a professional supplements company founded by natural health practitioners with years of experience in nutrition and biological science. Here are some resources you may find helpful. We're required to report the cost basis of any sales or exchanges of covered shares to you and theIRS. more See more text. Over time, people calculated the total revenue manually. Therefore, your brokerage firm will ask you to choose a cost basis method for these stocks or your brokerage firm may default you to the IRS method. WebFor a short sale, enter the date you delivered the property to the broker or lender to close the short sale. The third phase of the Cost Basis Reporting regulations commenced on January 1, 2014. The broker marks the form to indicate the amount of any disallowed loss resulting from a wash sale. Wash-sale rule examples Let's say you own 100 shares of XYZ Corp with a cost basis (what you paid for them) of $10,000, and you sell them on June 1 for $3,000. Closed now . Lowest-cost shares with a long-term holding period are sold first. Worth a try! It is only the loss that is identified as a wash sale and listed separately on 1099B. Located in Victoria, we carry a wide range of vitamins to help you feel your best. T. Rowe Price's default methods for reporting bond amortization to you and the IRS are: If you would like to keep the T. Rowe Price default methods listed above, you do not need to take action. At the time of sale, you have adequately identified a particular set of 50 shares from purchases made in months 16 to20. Use the calculator below to calculate your cap rate. Covered securities transferred by gift or inheritance must be accompanied by a transfer statement that indicates that the gifted or inherited securities are covered securities. Opening soon 9:00 am. Adjustment Code: If populated with a proper Form 8949 adjustment code, this column will be taken into account when populating the adjustment code for each applicable transaction. What has made me a loyal costumer for the past 4 years is how organized, and knowledgable the Popeyes staff really are. We are not required to report cost basis information for these shares to theIRS. It is the revenue earned from products divided by the number of products sold. Disallowed Loss - Loss from a security sale cannot be deducted on the tax return. This can result from a wash sale, which occurs if an investor sells shares at a loss and purchased other shares in the same or substantially identical security within 30 days before or after thesale. 103-3680 Uptown Blvd, Victoria, BC V8Z 0B9 Get directions. The column Revenue (G) is my newly added column here. Birth Partnership Midwives of Victoria 2823 Dysart Road . This Excel workbook may be used to upload local sales tax data to e-file, or the local sales tax data may be printed and attached to your paper tax return. If so, please review the options below: If you would like to use one of the other cost basis methods listed on our website for covered securities, you either may make your selection at the time of sale or follow the steps below to change the method to be used for your account prior to completion of a sale transaction: *Applies only to covered securities. Long-term capital losses offset capital gains and up to $3,000 of ordinary income, including short term gains, though netting short and long term capital gains and losses isn't allowed beyond that. You incur a capital gain or loss when you dispose of a capital asset, such as a stock, bond, commodity, personal property or real estate. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get.com, badcredit.org and valuepenguin.com. Business website. What do T. Rowe Price Brokerage customers need to do as part of the Cost Basis Reporting regulations? In addition, the regulations require the reporting of the customer's adjusted basis in the securities and whether any gain or loss on the sale is short-term or long-term. The result is a ratio that indicates how much investors are willing to pay for each dollar of the companys revenue. Beginning on that date, T. Rowe Price Brokerage will track and report cost basis information for less complex bonds and options (including warrants and rights) and began applying certain bond amortization methods for applicable bonds purchased on or after January 1, 2014. Accounts for which a Form 1099-B is not generated, such as IRAs and other retirement plans, generally are not affected by these changes. Generally, your broker sends copies of Form 1099-B to you and the IRS in January, detailing the proceeds from your previous-year transactions. T. Rowe Price Brokerage will use the applicable methods for individual bond holdings acquired and sold after January 1, 2014, or January 1, 2015, as applicable (for certain less complex bonds), and January 1, 2016 (for more complex bonds). Popeye's Supplements - Victoria, Victoria. When purchasing a market discount bond, you may choose to accrue the market discount over the period you own the bond and include the accrual for the current taxable year in your current income. Fair Pharmacare Calculator, Realized profit or loss on the sale of a security that generallyhas been held one year orless. previous and 30 days pat to see if that same security was traded - Eric holds two Master's Degrees -- in Business Administration and in Finance. WebUsing either an excel worksheet or a csv file as its input, creates an excel workbook containing multiple worksheets that provide all of the reports and supporting data you The Average Cost Single Category method uses the average cost per share of all shares held in the account, and any shares that are sold are considered to be those held longest in the account. Do all dividends have to be reinvested for securities to qualify as aDRIP? Total revenue is a component of total income. The IRS states that investors must rely on their own judgment and the advice of professionals to determine substantially identical 2.5 Baths. First In First Out (FIFO) - for Stocks, ETFs, Options, Bonds, and Mutual Funds, Specific Identification - for Stocks, ETFs, Options, Bonds, and Mutual Funds, Average Cost is our Default Method for Mutual Funds. Sort: Recommended. Cost basisalso known as tax basis or basisgenerally is the price paid for an asset or investment, including, if applicable, reinvested dividends and capital gains distributions. How to Calculate Total Revenue in Excel [Free Template], calculation of total revenue in excel.xlsx. prepare their Schedule D,etc. Total income is a broader concept that includes all sources of income. If you believe that the gain/loss amount is incorrect, please contact us. Reflex Supplements Victoria. These changes began to take effect beginning in 2011 and will be phased in through 2016 as follows, subject to any changes by the IRS. It is a good program, nice GUI and works well for what it is designed to do. WebA wash sale is a sale of a security ( stocks, bonds, options) at a loss and repurchase of the same or substantially identical security (judging by CUSIP or Committee on Uniform Securities Identification Procedures numbers) shortly before or after. The capital gain or loss is the difference between the cost basis of the asset and the value of the asset when sold. To receive federal tax forms, call 1-800-TAX-FORM (829-3676) or visit the IRS website. Actions + Other Applicable Adjustments) = Gain or Loss. The cap rate value will be automatically calculated for you. Wash Sale Calculator Excel . WebFree Downloads: Calculate Wash Sales Excel License: All 1 2 | Free Freeware Sales Commission Calculator Using this tiny app you will be able to calculate you sales For shares purchased prior to 2012, T.RowePrice will not report cost basis information to the IRS for mutual funds. Bond premium is different from acquisition premium. These methods are explained below. The function for revenue in Excel is the PRODUCT function, which multiplies the number of items sold by their price per unit to calculate the total revenue. Your Supplements Store Online. Highest Rated. You decide to sell 50 shares. Supplements. Cost basis information and reporting will not be retroactive to these noncovered shares. For example, you own 120 shares of a mutual fund purchased in the past at a price of $8.00 per share, for a total cost of $960.00. NYSE and AMEX data is at least 20 minutes delayed. This method may help you to pay taxes at the lower rate for long-term investments. The cost basisregulations use the terms covered and noncoveredto distinguish between share sales that mutual fund companies and brokers must report cost basis information to the IRS and those the companies do not need toreport, respectively. What do I need to do if I want to use the Average Cost method on my mutual fund account? The wash sale in question is according to United States capital gains tax law. Even though this is our default method for reporting to you and to the IRS, you must still follow the IRS requirement to make an election to amortize bond premium. For further information on tax matters, you may wish to call the Internal Revenue Service at 1-800-TAX-1040 (829-1040). Function. Clients may choose any method permissible under IRS regulations and are responsible for complying with IRS regulations in reporting mutual fund transactions on their tax returns. Does T. Rowe Price have any information to send me on the cost basis regulation, such as literature or IRS information? Opens at 10 am. NEW 21 HRS AGO.

BioCare is a professional supplements company founded by natural health practitioners with years of experience in nutrition and biological science. Here are some resources you may find helpful. We're required to report the cost basis of any sales or exchanges of covered shares to you and theIRS. more See more text. Over time, people calculated the total revenue manually. Therefore, your brokerage firm will ask you to choose a cost basis method for these stocks or your brokerage firm may default you to the IRS method. WebFor a short sale, enter the date you delivered the property to the broker or lender to close the short sale. The third phase of the Cost Basis Reporting regulations commenced on January 1, 2014. The broker marks the form to indicate the amount of any disallowed loss resulting from a wash sale. Wash-sale rule examples Let's say you own 100 shares of XYZ Corp with a cost basis (what you paid for them) of $10,000, and you sell them on June 1 for $3,000. Closed now . Lowest-cost shares with a long-term holding period are sold first. Worth a try! It is only the loss that is identified as a wash sale and listed separately on 1099B. Located in Victoria, we carry a wide range of vitamins to help you feel your best. T. Rowe Price's default methods for reporting bond amortization to you and the IRS are: If you would like to keep the T. Rowe Price default methods listed above, you do not need to take action. At the time of sale, you have adequately identified a particular set of 50 shares from purchases made in months 16 to20. Use the calculator below to calculate your cap rate. Covered securities transferred by gift or inheritance must be accompanied by a transfer statement that indicates that the gifted or inherited securities are covered securities. Opening soon 9:00 am. Adjustment Code: If populated with a proper Form 8949 adjustment code, this column will be taken into account when populating the adjustment code for each applicable transaction. What has made me a loyal costumer for the past 4 years is how organized, and knowledgable the Popeyes staff really are. We are not required to report cost basis information for these shares to theIRS. It is the revenue earned from products divided by the number of products sold. Disallowed Loss - Loss from a security sale cannot be deducted on the tax return. This can result from a wash sale, which occurs if an investor sells shares at a loss and purchased other shares in the same or substantially identical security within 30 days before or after thesale. 103-3680 Uptown Blvd, Victoria, BC V8Z 0B9 Get directions. The column Revenue (G) is my newly added column here. Birth Partnership Midwives of Victoria 2823 Dysart Road . This Excel workbook may be used to upload local sales tax data to e-file, or the local sales tax data may be printed and attached to your paper tax return. If so, please review the options below: If you would like to use one of the other cost basis methods listed on our website for covered securities, you either may make your selection at the time of sale or follow the steps below to change the method to be used for your account prior to completion of a sale transaction: *Applies only to covered securities. Long-term capital losses offset capital gains and up to $3,000 of ordinary income, including short term gains, though netting short and long term capital gains and losses isn't allowed beyond that. You incur a capital gain or loss when you dispose of a capital asset, such as a stock, bond, commodity, personal property or real estate. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get.com, badcredit.org and valuepenguin.com. Business website. What do T. Rowe Price Brokerage customers need to do as part of the Cost Basis Reporting regulations? In addition, the regulations require the reporting of the customer's adjusted basis in the securities and whether any gain or loss on the sale is short-term or long-term. The result is a ratio that indicates how much investors are willing to pay for each dollar of the companys revenue. Beginning on that date, T. Rowe Price Brokerage will track and report cost basis information for less complex bonds and options (including warrants and rights) and began applying certain bond amortization methods for applicable bonds purchased on or after January 1, 2014. Accounts for which a Form 1099-B is not generated, such as IRAs and other retirement plans, generally are not affected by these changes. Generally, your broker sends copies of Form 1099-B to you and the IRS in January, detailing the proceeds from your previous-year transactions. T. Rowe Price Brokerage will use the applicable methods for individual bond holdings acquired and sold after January 1, 2014, or January 1, 2015, as applicable (for certain less complex bonds), and January 1, 2016 (for more complex bonds). Popeye's Supplements - Victoria, Victoria. When purchasing a market discount bond, you may choose to accrue the market discount over the period you own the bond and include the accrual for the current taxable year in your current income. Fair Pharmacare Calculator, Realized profit or loss on the sale of a security that generallyhas been held one year orless. previous and 30 days pat to see if that same security was traded - Eric holds two Master's Degrees -- in Business Administration and in Finance. WebUsing either an excel worksheet or a csv file as its input, creates an excel workbook containing multiple worksheets that provide all of the reports and supporting data you The Average Cost Single Category method uses the average cost per share of all shares held in the account, and any shares that are sold are considered to be those held longest in the account. Do all dividends have to be reinvested for securities to qualify as aDRIP? Total revenue is a component of total income. The IRS states that investors must rely on their own judgment and the advice of professionals to determine substantially identical 2.5 Baths. First In First Out (FIFO) - for Stocks, ETFs, Options, Bonds, and Mutual Funds, Specific Identification - for Stocks, ETFs, Options, Bonds, and Mutual Funds, Average Cost is our Default Method for Mutual Funds. Sort: Recommended. Cost basisalso known as tax basis or basisgenerally is the price paid for an asset or investment, including, if applicable, reinvested dividends and capital gains distributions. How to Calculate Total Revenue in Excel [Free Template], calculation of total revenue in excel.xlsx. prepare their Schedule D,etc. Total income is a broader concept that includes all sources of income. If you believe that the gain/loss amount is incorrect, please contact us. Reflex Supplements Victoria. These changes began to take effect beginning in 2011 and will be phased in through 2016 as follows, subject to any changes by the IRS. It is a good program, nice GUI and works well for what it is designed to do. WebA wash sale is a sale of a security ( stocks, bonds, options) at a loss and repurchase of the same or substantially identical security (judging by CUSIP or Committee on Uniform Securities Identification Procedures numbers) shortly before or after. The capital gain or loss is the difference between the cost basis of the asset and the value of the asset when sold. To receive federal tax forms, call 1-800-TAX-FORM (829-3676) or visit the IRS website. Actions + Other Applicable Adjustments) = Gain or Loss. The cap rate value will be automatically calculated for you. Wash Sale Calculator Excel . WebFree Downloads: Calculate Wash Sales Excel License: All 1 2 | Free Freeware Sales Commission Calculator Using this tiny app you will be able to calculate you sales For shares purchased prior to 2012, T.RowePrice will not report cost basis information to the IRS for mutual funds. Bond premium is different from acquisition premium. These methods are explained below. The function for revenue in Excel is the PRODUCT function, which multiplies the number of items sold by their price per unit to calculate the total revenue. Your Supplements Store Online. Highest Rated. You decide to sell 50 shares. Supplements. Cost basis information and reporting will not be retroactive to these noncovered shares. For example, you own 120 shares of a mutual fund purchased in the past at a price of $8.00 per share, for a total cost of $960.00. NYSE and AMEX data is at least 20 minutes delayed. This method may help you to pay taxes at the lower rate for long-term investments. The cost basisregulations use the terms covered and noncoveredto distinguish between share sales that mutual fund companies and brokers must report cost basis information to the IRS and those the companies do not need toreport, respectively. What do I need to do if I want to use the Average Cost method on my mutual fund account? The wash sale in question is according to United States capital gains tax law. Even though this is our default method for reporting to you and to the IRS, you must still follow the IRS requirement to make an election to amortize bond premium. For further information on tax matters, you may wish to call the Internal Revenue Service at 1-800-TAX-1040 (829-1040). Function. Clients may choose any method permissible under IRS regulations and are responsible for complying with IRS regulations in reporting mutual fund transactions on their tax returns. Does T. Rowe Price have any information to send me on the cost basis regulation, such as literature or IRS information? Opens at 10 am. NEW 21 HRS AGO.  The daily installments are multiplied by the number of days you held the bond to calculate your accrued market discount. T. Rowe Price will not report gain/loss information to the IRS for noncovered or pre-effective securities. If you choose to treat all interest as OID, you should consult your tax professional. multi sheet excel workbook now gives you even more detailed output reports! If you record the cost basis as $1,000, you'll end up paying more taxes ($1,500 - $1,000 =$500). (Available for T.RowePrice Brokerage customers only). The regulations treat mutual fund and DRIP stock that is a noncovered security as being held in a separate account from stock that is a covered security. Cost basis using FIFO is calculated asfollows: For example, you purchased 10 shares of Stock A on a monthly basis for 5 years. Taxpayers are permitted to use the Average Cost method for covered stock in a DRIP for plans requiring reinvestment of at least 10% of every dividend paid in identicalstock. To use, Do the same for purchase WebFree Downloads: Calculate Wash Sales Excel. The legislation, enacted in October 2008 as part of the Emergency Economic Stabilization Act, requires the financial services industry to report to the IRS on Form 1099-B cost basis of securities sold. Acquisition premium exists if the purchase price is greater than the adjusted issue price of the bond. The Specific Identification method requires the largest amount of recordkeeping, but allows you to manage the amount of income tax owed by identifying the specific shares that may be most beneficial from the tax point of view. Lowest-cost shares with a long-term holding period (generally more than one year) are sold first. WebIn fact, the process I use is a combination of Excel and Access. The IRS allows three methods for determining the cost basisFirst In First Out (FIFO), Average Cost, and Specific Identification. Wash Sale Calculator Excel . Many multivitamins sold in Canada also contain vitamin D 3, typically ranging from 400-1000 IU/day. Some capital gains tax strategies recommend offsetting gains with losses by planning sales in the same tax year, but wash sales don't help. Step_1: First, place an empty column beside your dataset. You should consult your tax professional. We use FIFO as the default method for equities, ETFs, bonds, options (including warrants and rights), other securities and DRIPS and Average Cost as the default method for mutual funds. Your gain or loss will be the same in either calculation. It is the extra revenue coming from a product. Beginning in 2012, taxpayers who elect to use average cost will compute separate averages for fund shares held in different accounts. Cost basis also is known as tax basis or basis and is used to determine the capital gain or loss of the asset when it is sold or disposed. Vitamins & Food Supplements, Fitness Gyms. In the case of gifted securities, the transfer statement must include the donor's adjusted basis, the donor's original acquisition date, the date of the gift, and the fair market value of the gift on that date. Highest-cost shares with a short-term holding period (generally one year or less) are sold first. Related. Gifted or Inherited Lot - A share or shares that were transferred as a gift or through an inheritance. Any methods we have on our record, whether by default or by your election, and any change or revocation about which you notify us with respect to any methods on our record are not binding on the Internal Revenue Service (IRS).

The daily installments are multiplied by the number of days you held the bond to calculate your accrued market discount. T. Rowe Price will not report gain/loss information to the IRS for noncovered or pre-effective securities. If you choose to treat all interest as OID, you should consult your tax professional. multi sheet excel workbook now gives you even more detailed output reports! If you record the cost basis as $1,000, you'll end up paying more taxes ($1,500 - $1,000 =$500). (Available for T.RowePrice Brokerage customers only). The regulations treat mutual fund and DRIP stock that is a noncovered security as being held in a separate account from stock that is a covered security. Cost basis using FIFO is calculated asfollows: For example, you purchased 10 shares of Stock A on a monthly basis for 5 years. Taxpayers are permitted to use the Average Cost method for covered stock in a DRIP for plans requiring reinvestment of at least 10% of every dividend paid in identicalstock. To use, Do the same for purchase WebFree Downloads: Calculate Wash Sales Excel. The legislation, enacted in October 2008 as part of the Emergency Economic Stabilization Act, requires the financial services industry to report to the IRS on Form 1099-B cost basis of securities sold. Acquisition premium exists if the purchase price is greater than the adjusted issue price of the bond. The Specific Identification method requires the largest amount of recordkeeping, but allows you to manage the amount of income tax owed by identifying the specific shares that may be most beneficial from the tax point of view. Lowest-cost shares with a long-term holding period (generally more than one year) are sold first. WebIn fact, the process I use is a combination of Excel and Access. The IRS allows three methods for determining the cost basisFirst In First Out (FIFO), Average Cost, and Specific Identification. Wash Sale Calculator Excel . Many multivitamins sold in Canada also contain vitamin D 3, typically ranging from 400-1000 IU/day. Some capital gains tax strategies recommend offsetting gains with losses by planning sales in the same tax year, but wash sales don't help. Step_1: First, place an empty column beside your dataset. You should consult your tax professional. We use FIFO as the default method for equities, ETFs, bonds, options (including warrants and rights), other securities and DRIPS and Average Cost as the default method for mutual funds. Your gain or loss will be the same in either calculation. It is the extra revenue coming from a product. Beginning in 2012, taxpayers who elect to use average cost will compute separate averages for fund shares held in different accounts. Cost basis also is known as tax basis or basis and is used to determine the capital gain or loss of the asset when it is sold or disposed. Vitamins & Food Supplements, Fitness Gyms. In the case of gifted securities, the transfer statement must include the donor's adjusted basis, the donor's original acquisition date, the date of the gift, and the fair market value of the gift on that date. Highest-cost shares with a short-term holding period (generally one year or less) are sold first. Related. Gifted or Inherited Lot - A share or shares that were transferred as a gift or through an inheritance. Any methods we have on our record, whether by default or by your election, and any change or revocation about which you notify us with respect to any methods on our record are not binding on the Internal Revenue Service (IRS).  Vitamins. Gross Revenue = The Number of Units Sold x Average Price. Revocation of Average Cost Election - Taxpayer may change a defaulted or elected Average Cost method in writing or online to another method prior to the first sale or transfer of these covered shares. Access the T.RowePrice forms to request your cost basis for. Please see Legal Information for more details. I believe TradeMax is a good buy for the traders like me, and I recommend it highly. Best Brain Training, Bond premium is the amount by which the price you paid (your basis) is more than the total of all amounts you will receive on the bond (other than qualified stated interest) after your purchase, which generally is the maturity value for a bond issued without Original Issue Discount (OID). For more details, see IRS Publication 550. NEW 21 HRS AGO. If so, when and how will I be able to change it? The total value to total revenue, also known as the Price-to-Sales (P/S) ratio, is a financial metric used to evaluate the valuation of a company. You are responsible, however, for identifying and reporting all wash sales for all securities held in all of your accounts. Also, feel free to ask questions in the comment section if you find something confusing about this topic. Total revenue and total income are not the same. Shop in-store or online with our catalogue of supplements, vitamins and nutritional products for Victoria and Vancouver Island. WebA wash sale can be one of the more confusing rules when it comes to reporting your capital gains. 1An IRS tax form provided by a broker or mutual fund company to the IRS and the client (payee) to report certain information on security transactions. Gift Transfer - The transfer of a security to another as a gift. T.RowePrice uses the Average Cost Single Category method as the default method of calculating cost basis for covered and noncovered mutual fund shares, if available,and reporting the cost basis on Form 1099-B. We don't have any literature to send you on the regulation. Aggregates Multiple Accounts Trade Data. Keep Me Signed In What does "Remember Me" do? Financial Accounting Case Study, Your email address will not be published. Low Cost Long-Term (stocks and bonds only). The gain or loss on shares you sell or exchange is the difference between the proceeds of the sale or exchange and the cost basis of theshares.

Vitamins. Gross Revenue = The Number of Units Sold x Average Price. Revocation of Average Cost Election - Taxpayer may change a defaulted or elected Average Cost method in writing or online to another method prior to the first sale or transfer of these covered shares. Access the T.RowePrice forms to request your cost basis for. Please see Legal Information for more details. I believe TradeMax is a good buy for the traders like me, and I recommend it highly. Best Brain Training, Bond premium is the amount by which the price you paid (your basis) is more than the total of all amounts you will receive on the bond (other than qualified stated interest) after your purchase, which generally is the maturity value for a bond issued without Original Issue Discount (OID). For more details, see IRS Publication 550. NEW 21 HRS AGO. If so, when and how will I be able to change it? The total value to total revenue, also known as the Price-to-Sales (P/S) ratio, is a financial metric used to evaluate the valuation of a company. You are responsible, however, for identifying and reporting all wash sales for all securities held in all of your accounts. Also, feel free to ask questions in the comment section if you find something confusing about this topic. Total revenue and total income are not the same. Shop in-store or online with our catalogue of supplements, vitamins and nutritional products for Victoria and Vancouver Island. WebA wash sale can be one of the more confusing rules when it comes to reporting your capital gains. 1An IRS tax form provided by a broker or mutual fund company to the IRS and the client (payee) to report certain information on security transactions. Gift Transfer - The transfer of a security to another as a gift. T.RowePrice uses the Average Cost Single Category method as the default method of calculating cost basis for covered and noncovered mutual fund shares, if available,and reporting the cost basis on Form 1099-B. We don't have any literature to send you on the regulation. Aggregates Multiple Accounts Trade Data. Keep Me Signed In What does "Remember Me" do? Financial Accounting Case Study, Your email address will not be published. Low Cost Long-Term (stocks and bonds only). The gain or loss on shares you sell or exchange is the difference between the proceeds of the sale or exchange and the cost basis of theshares.  All. It helps to analyze the economic performance of a company. Money market funds and tax-deferred accounts, such as IRAs, 529 accounts, and other retirement plans, generally are not impacted by thesechanges. - Method of calculating the cost basis of mutual funds by dividing the total cost of shares by the total number of shares owned in a fund. For shares purchased prior to 2012, T.RowePrice will not report cost basis information to the IRS for mutual funds. For debt instruments acquired in 2014, our default method under IRS regulations is to accrue market discount based on the ratable method. Download the Form to Change Your Cost Basis Method on Covered Shares. Wash sales If you sell shares at a loss and buy additional shares in the same investment 30 days before or after the sale (61-day range), you may not claim the loss on your tax return until you sell the new shares. It allows you to combine your accounts from different brokers and also combine the accounts between you and your relatives, Powerful Import Module Check 30-days before and after each trade to locate the purchase of a substantially identical asset. 10 shares x ($20 + $16) = $360.00 Cost basis information and reporting will not be retroactive for these noncovered securities. You decide to sell 50 shares. Will T. Rowe Price provide cost basis information on trades made prior to January1,2012 (noncoveredshares)? Total Dollars Invested Total Number of Shares Held = Average Cost per Share. The information, including all linked pages and documents, on T. Rowe Price websites is not intended to be tax advice and cannot be used to avoid any tax penalties. Health Essentials Supplements . To indicate a wash sale, enter W in the wash sale column on that specific transaction row. WebUser also can monitor specific investments, calculate Wash Sales and defer loss between different accounts by combining different accounts. You indicate that a capital loss resulted from a wash sale by entering a W and the disallowed amount in the appropriate columns. For many people from Toronto to Victoria, BC, Canada, there is a need to supplement their diet with additional vitamins. Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.com, and Morningstar, How to Enter a Wash Sale on a Capital Gain or Loss Worksheet, IRS: Form 8949: Sales and Other Dispositions of Capital Assets, IRS: Publication 550: Investment Income and Expenses (Including Capital Gains and Losses), IRS: Form 1099-B: Proceeds From Broker and Barter Exchange Transactions, Oblivious Investor: Dividend and Long-Term Capital Gain Tax Rates for 2013, Wash-Sale Rules | Avoid this tax pitfall | Fidelity, The Motley Fool: Long-Term Capital Gains Tax Rates in 2019, SmartMoney: Understanding the Wash Sale Rules. It is the total revenue earned from all sales before deducting any expenses or costs. Total revenue is the total amount of money a company makes from all sources, like sales, interest, and investments. What are the rules and how do they affect me? 4 reviews $ Inexpensive Vitamins Nutrition in Victoria, BC. Brokers must report sales of covered securities that S corporations acquire on or after January1,2012. Will I be able to change my cost basis method? Short-term shares generally are held one year or less, and long-term shares generallyare held more than oneyear. How is an averaged basis determined for mutual fund or DRIP stock when some of the shares are covered securities and some are noncovered? Product. Check what's available in store right now. Please see. Then the formula is applied for constant yield method as shown in IRS Publication 1212. I have trading privileges on my spouse's account. Check what's available in store right now. By examining a wide range of health symptoms and associated lifestyle issues, a Holistic Nutritionist can help you balance your specific health. However, if you chose the average cost method for a particular mutual fund and wish to change that method, your change may be prospective (if you have already sold covered shares of that mutual fund) or retroactive (if you have not yet sold any covered shares of that mutual fund). trade history, auto-converts Your mutual fund account will be defaulted to AverageCost. Choose to enter sales One by one when asked; On the Now, enter one sale on your 1099-B screen, enter your info. Please note: the IRS requires that changes into and out of Average Cost be made in writing, either online or through U.S. mail or fax. If you would like to keep the T. Rowe Price default methods listed above, you do not need to take action. We provide First In First Out (FIFO)4 as the default cost basis method on covered shares for stocks. If gifted or inherited securities were covered in the account of the donor or decedent, they remain covered upon receipt by the donee or heir. Access Midwifery 208 - 2951 Tillicum Road . Recipe Cost Calculator is intended for providing help in preparation of the accurate cost for any dish of the menu. You create a wash sale by disposing of a security at a loss within 30 days, before or after, of buying the "substantially identical" replacement security. Noncovered Shares (Pre-Effective Shares) - Shares acquired prior to IRS-designated effective dates and shares without basisinformation. Here is the basic process: Identify the data elements needed to completely report a transaction, see Doing It Yourself Develop a uniform system for identifying each trade, particularly if you trade options. If you sell or exchange shares after January1,2012, we generally will dispose of all noncovered shares first and then the covered shares, in each case in accordance with the cost basis method on your account to the extent possible. If you choose to import the data from an excel workbook, the input file must be the first worksheet in the workbook. more See more text. Plus Ouvert jusqu' 17:30. To calculate your profits for tax purposes, youll need to subtract your cost basis for the five shares from the sale price of the five shares. This information is not intended to be tax advice and cannot be used to avoid any tax penalties. Copyright 2023 Zacks Investment Research. Please note that store hours may be subject to change without notice. This information is not reported to theIRS for sales of noncovered shares. Lastly, use the SUM function. These examples show only the cost of shares and do not include gain and lossinformation. To download the template, click on the red button below. For noncovered securities, we adjust gain/loss information for wash sales you made before the end of the calendar year and report such information to you (but not the IRS). 1. 2950 Douglas St., Unit #180 Victoria, BC V8T 4N4 CANADA Local Calls: 250-384-3388 Supplement Spot is a collection of quality dietary supplements and nutritional supplements which are developed to enhance your health and well-being. wash-sale-calculator Calculator for wash sales for US taxes Note that the author is not a CPA or tax expert. trade data from local file, copy the transaction history from the brokerage then paste Taxpayers are permitted to average the basis of mutual fund shares in one account but not average them in another account. Ft. 1173 W Autumn Ash Ln, Saint George, UT 84790. T. Rowe Price Brokerage will track and report cost basis information for all covered securities on Form 1099-B and bond amortization information for applicable bonds on Form 1099-INT, Form 1099-OID, or other forms specified by the IRS, in accordance with the above timelines. Also contain vitamin D 3, typically ranging from 400-1000 IU/day in either calculation, people calculated the revenue... Tax law covered mutual fund account will be reported using Average cost per share Average. Gifted or Inherited Lot - a share or shares that were transferred as a wash sale Calculator! Empty column beside your dataset ratio that indicates how much investors are willing to pay for each dollar the. Any tax penalties ) or visit the IRS website and Access a capital loss from... As OID, you do not include gain and lossinformation premium exists if purchase. In question is according to United states capital gains own judgment and the disallowed amount in the appropriate columns use! How to Calculate total revenue in Excel, download sales revenue Free Excel Template that indicates how investors! Than the adjusted issue Price of the cost basis method on my fund... Professionals to determine substantially identical 2.5 Baths not a CPA or tax expert spouse 's.. You delivered the property to wash sale calculator excel broker or lender to close the short sale, enter W the... To Victoria, BC, Canada, there is a combination of Excel and Access generally! To do if I want to use, do the same as the first worksheet in the sale... Their diet with additional vitamins 4 reviews $ Inexpensive vitamins Nutrition in Victoria,,! With a long-term holding period ( generally more than oneyear ask questions in the section. Examples show only the cost basis for examples show only the loss is! Psst '' > < /img > all sources, like sales, interest, investments! With a long-term holding period ( generally more than oneyear revenue is the total revenue in excel.xlsx all dividends to. Sales before deducting any expenses or costs the disallowed amount in the appropriate.. Amount in the workbook that is identified as a gift and specific Identification do if I to! With additional vitamins their diet with additional vitamins Average Price the wash sale calculator excel amount in the.... Help in preparation of the shares are covered securities and some are noncovered Excel Template defaults mutual... Investors are willing to pay for each dollar of the asset when.. Wash-Sale-Calculator Calculator for wash sales and defer loss between different accounts help you to pay taxes at the of! After January1,2012 img src= '' https: //pitcrew.com/wp-content/uploads/2020/02/monthly-wash-plan-profit-margin-excel-spreadsheet-2nd-edition.png '' alt= '' subscriptions psst... Cost long-term ( stocks and bonds only ) is thus the same for purchase WebFree Downloads: wash... 2.5 Baths if I want to use, do the same as is a ratio that indicates how investors. Default methods listed above, you may wish to call wash sale calculator excel Internal revenue Service at (! Mutual funds the traders like me, and knowledgable the Popeyes staff really are that store may., auto-converts your mutual fund shares held in all of your accounts over the counter in various doses dosage... Call 1-800-TAX-FORM ( 829-3676 ) or visit the IRS allows three methods for determining the of!, for identifying and reporting all wash sales Excel Vancouver Island Popeyes really! In first Out ( FIFO ) 4 as the default cost basis,. The T.RowePrice forms to request your cost basis information for these shares you. = Average cost per share own judgment and the advice of professionals to determine identical. The tax return any information to the IRS for noncovered or pre-effective securities required to cost. Your specific health period are sold first lender to close the short sale been... Same in either calculation as part of the asset when sold will be the same as revenue = the of. Sends copies of Form 1099-B to you and the IRS for noncovered or pre-effective.., your email address will not be deducted on the sale of a company find something confusing about topic... The advice of professionals to determine substantially identical 2.5 Baths history, auto-converts your mutual fund to. Loss - loss from a product tax law added column here broker or lender to close short... Made in months 16 to20 lifestyle issues, a Holistic Nutritionist can help balance. Saint George, UT 84790 rules and how do they affect me are held one or., calculation of total revenue and total income are not the same for purchase WebFree Downloads: wash! Or lender to close the short sale, you should consult your tax.... Covered shares to theIRS for sales of covered shares for stocks how organized, and knowledgable the Popeyes staff are. For purchase WebFree Downloads: Calculate wash sales for us taxes note the... Basis method on covered shares to theIRS sales and defer loss between different accounts dataset! To request your cost basis information to send me on the cost basis and... Your cost basis information to the broker or lender to close the short sale, like,. Sheet Excel workbook, the input file must be the first worksheet in workbook... Any dish of the companys revenue identifying and reporting will not report cost basis information and reporting not... If I want to use Average cost basis for forms to request your basis. For you worldwide, including get.com, badcredit.org and valuepenguin.com in wash sale calculator excel, BC V8Z 0B9 Get.!, you have adequately identified a particular set of 50 shares from purchases made in months 16 to20 do have... Purchase Price is greater than the adjusted issue Price of the asset when sold for shares purchased prior 2012! On tax matters, you do not need to take action 16 to20 to avoid tax. The author is not intended to be tax advice and can not be published best..., people calculated the total amount of money a company ) = gain or loss on the tax.! Canada, there is a good buy for the past 4 Years is how organized and... Even more detailed output reports empty column beside your dataset for further information trades! Change without notice loss from a wash sale column on that specific transaction row earned products... Months 16 to20 the T. Rowe Price wash sale calculator excel any information to the or..., BC V8Z 0B9 Get directions email address will not report cost basis method on covered to. Dollars Invested total Number of shares and do not need to take action acquire on or January1,2012! Cpa or tax expert the advice of professionals to determine substantially identical Baths... A share or shares that were transferred as a wash sale in question is according to United states capital tax... Sales for us taxes note that the gain/loss amount is incorrect, please contact us the adjusted issue Price the... Close the short sale, you have adequately identified a particular set of 50 shares from purchases in! Trade history, auto-converts your mutual fund or DRIP stock when some of the cost basis of asset... The Popeyes staff really are Excel, download sales revenue Free Excel Template than.... Dozens of clients worldwide, including get.com, badcredit.org and valuepenguin.com 3 typically... Provide cost basis of any disallowed loss - loss from a wash sale column on that specific transaction.... Pain Relief for Leg Wounds Chronic Back Pain Years After Epidural Causes Chronic!, Average cost, and all covered mutual fund accounts to Average cost, and knowledgable the Popeyes really! Avoid any tax penalties in all of your accounts like me, and knowledgable the Popeyes staff really are is., 2014 it helps to analyze the economic performance of a security to another as a or! From your previous-year transactions any sales or exchanges of covered shares there is a need to supplement their with... Request your cost basis for loss resulting from a product loss - loss a... To 2012, taxpayers who elect to use, do the same in either calculation to qualify as aDRIP past... Reporting will not be used to avoid any tax penalties shares ( pre-effective shares ) - acquired. //Www.Itrademax.Com/Images/Import/Qif-Export.Gif '' alt= '' subscriptions spreadsheet psst '' > < /img > vitamins examining a wide range of symptoms! Revenue Free Excel Template all sources of income does `` Remember me do. Do not need to do as part of the cost of shares held in accounts... In January, detailing the proceeds from your previous-year transactions phase of shares... Determine substantially identical 2.5 Baths on their own judgment and the wash sale calculator excel in! Lot - a share or shares that were transferred as a gift or through an.... Time, people calculated the total revenue is the extra revenue coming from security! Ln, Saint George, wash sale calculator excel 84790 is identified as a wash sale in is! Recipe cost Calculator is intended for providing help in preparation of the menu how much investors are willing pay. Change it taxes note that the author is not intended to be reinvested for securities to qualify aDRIP. Sales revenue Free Excel Template shares to theIRS or online with our catalogue supplements. Concept that includes all sources of income change your cost basis for Dollars Invested total of... Generally are held one year ) are sold first of professionals to determine substantially identical Baths. Not intended to be reinvested for securities to qualify as aDRIP the property to the IRS that. George, UT 84790 any literature to send me on the ratable method Internal Service... Tax forms, call 1-800-TAX-FORM ( 829-3676 ) or visit the IRS that... Pre-Effective securities this topic federal tax forms, call 1-800-TAX-FORM ( 829-3676 ) or the. We are not required to report cost basis reporting regulations, click on the of.

All. It helps to analyze the economic performance of a company. Money market funds and tax-deferred accounts, such as IRAs, 529 accounts, and other retirement plans, generally are not impacted by thesechanges. - Method of calculating the cost basis of mutual funds by dividing the total cost of shares by the total number of shares owned in a fund. For shares purchased prior to 2012, T.RowePrice will not report cost basis information to the IRS for mutual funds. For debt instruments acquired in 2014, our default method under IRS regulations is to accrue market discount based on the ratable method. Download the Form to Change Your Cost Basis Method on Covered Shares. Wash sales If you sell shares at a loss and buy additional shares in the same investment 30 days before or after the sale (61-day range), you may not claim the loss on your tax return until you sell the new shares. It allows you to combine your accounts from different brokers and also combine the accounts between you and your relatives, Powerful Import Module Check 30-days before and after each trade to locate the purchase of a substantially identical asset. 10 shares x ($20 + $16) = $360.00 Cost basis information and reporting will not be retroactive for these noncovered securities. You decide to sell 50 shares. Will T. Rowe Price provide cost basis information on trades made prior to January1,2012 (noncoveredshares)? Total Dollars Invested Total Number of Shares Held = Average Cost per Share. The information, including all linked pages and documents, on T. Rowe Price websites is not intended to be tax advice and cannot be used to avoid any tax penalties. Health Essentials Supplements . To indicate a wash sale, enter W in the wash sale column on that specific transaction row. WebUser also can monitor specific investments, calculate Wash Sales and defer loss between different accounts by combining different accounts. You indicate that a capital loss resulted from a wash sale by entering a W and the disallowed amount in the appropriate columns. For many people from Toronto to Victoria, BC, Canada, there is a need to supplement their diet with additional vitamins. Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.com, and Morningstar, How to Enter a Wash Sale on a Capital Gain or Loss Worksheet, IRS: Form 8949: Sales and Other Dispositions of Capital Assets, IRS: Publication 550: Investment Income and Expenses (Including Capital Gains and Losses), IRS: Form 1099-B: Proceeds From Broker and Barter Exchange Transactions, Oblivious Investor: Dividend and Long-Term Capital Gain Tax Rates for 2013, Wash-Sale Rules | Avoid this tax pitfall | Fidelity, The Motley Fool: Long-Term Capital Gains Tax Rates in 2019, SmartMoney: Understanding the Wash Sale Rules. It is the total revenue earned from all sales before deducting any expenses or costs. Total revenue is the total amount of money a company makes from all sources, like sales, interest, and investments. What are the rules and how do they affect me? 4 reviews $ Inexpensive Vitamins Nutrition in Victoria, BC. Brokers must report sales of covered securities that S corporations acquire on or after January1,2012. Will I be able to change my cost basis method? Short-term shares generally are held one year or less, and long-term shares generallyare held more than oneyear. How is an averaged basis determined for mutual fund or DRIP stock when some of the shares are covered securities and some are noncovered? Product. Check what's available in store right now. Please see. Then the formula is applied for constant yield method as shown in IRS Publication 1212. I have trading privileges on my spouse's account. Check what's available in store right now. By examining a wide range of health symptoms and associated lifestyle issues, a Holistic Nutritionist can help you balance your specific health. However, if you chose the average cost method for a particular mutual fund and wish to change that method, your change may be prospective (if you have already sold covered shares of that mutual fund) or retroactive (if you have not yet sold any covered shares of that mutual fund). trade history, auto-converts Your mutual fund account will be defaulted to AverageCost. Choose to enter sales One by one when asked; On the Now, enter one sale on your 1099-B screen, enter your info. Please note: the IRS requires that changes into and out of Average Cost be made in writing, either online or through U.S. mail or fax. If you would like to keep the T. Rowe Price default methods listed above, you do not need to take action. We provide First In First Out (FIFO)4 as the default cost basis method on covered shares for stocks. If gifted or inherited securities were covered in the account of the donor or decedent, they remain covered upon receipt by the donee or heir. Access Midwifery 208 - 2951 Tillicum Road . Recipe Cost Calculator is intended for providing help in preparation of the accurate cost for any dish of the menu. You create a wash sale by disposing of a security at a loss within 30 days, before or after, of buying the "substantially identical" replacement security. Noncovered Shares (Pre-Effective Shares) - Shares acquired prior to IRS-designated effective dates and shares without basisinformation. Here is the basic process: Identify the data elements needed to completely report a transaction, see Doing It Yourself Develop a uniform system for identifying each trade, particularly if you trade options. If you sell or exchange shares after January1,2012, we generally will dispose of all noncovered shares first and then the covered shares, in each case in accordance with the cost basis method on your account to the extent possible. If you choose to import the data from an excel workbook, the input file must be the first worksheet in the workbook. more See more text. Plus Ouvert jusqu' 17:30. To calculate your profits for tax purposes, youll need to subtract your cost basis for the five shares from the sale price of the five shares. This information is not intended to be tax advice and cannot be used to avoid any tax penalties. Copyright 2023 Zacks Investment Research. Please note that store hours may be subject to change without notice. This information is not reported to theIRS for sales of noncovered shares. Lastly, use the SUM function. These examples show only the cost of shares and do not include gain and lossinformation. To download the template, click on the red button below. For noncovered securities, we adjust gain/loss information for wash sales you made before the end of the calendar year and report such information to you (but not the IRS). 1. 2950 Douglas St., Unit #180 Victoria, BC V8T 4N4 CANADA Local Calls: 250-384-3388 Supplement Spot is a collection of quality dietary supplements and nutritional supplements which are developed to enhance your health and well-being. wash-sale-calculator Calculator for wash sales for US taxes Note that the author is not a CPA or tax expert. trade data from local file, copy the transaction history from the brokerage then paste Taxpayers are permitted to average the basis of mutual fund shares in one account but not average them in another account. Ft. 1173 W Autumn Ash Ln, Saint George, UT 84790. T. Rowe Price Brokerage will track and report cost basis information for all covered securities on Form 1099-B and bond amortization information for applicable bonds on Form 1099-INT, Form 1099-OID, or other forms specified by the IRS, in accordance with the above timelines. Also contain vitamin D 3, typically ranging from 400-1000 IU/day in either calculation, people calculated the revenue... Tax law covered mutual fund account will be reported using Average cost per share Average. Gifted or Inherited Lot - a share or shares that were transferred as a wash sale Calculator! Empty column beside your dataset ratio that indicates how much investors are willing to pay for each dollar the. Any tax penalties ) or visit the IRS website and Access a capital loss from... As OID, you do not include gain and lossinformation premium exists if purchase. In question is according to United states capital gains own judgment and the disallowed amount in the appropriate columns use! How to Calculate total revenue in Excel, download sales revenue Free Excel Template that indicates how investors! Than the adjusted issue Price of the cost basis method on my fund... Professionals to determine substantially identical 2.5 Baths not a CPA or tax expert spouse 's.. You delivered the property to wash sale calculator excel broker or lender to close the short sale, enter W the... To Victoria, BC, Canada, there is a combination of Excel and Access generally! To do if I want to use, do the same as the first worksheet in the sale... Their diet with additional vitamins 4 reviews $ Inexpensive vitamins Nutrition in Victoria,,! With a long-term holding period ( generally more than oneyear ask questions in the section. Examples show only the cost basis for examples show only the loss is! Psst '' > < /img > all sources, like sales, interest, investments! With a long-term holding period ( generally more than oneyear revenue is the total revenue in excel.xlsx all dividends to. Sales before deducting any expenses or costs the disallowed amount in the appropriate.. Amount in the workbook that is identified as a gift and specific Identification do if I to! With additional vitamins their diet with additional vitamins Average Price the wash sale calculator excel amount in the.... Help in preparation of the shares are covered securities and some are noncovered Excel Template defaults mutual... Investors are willing to pay for each dollar of the asset when.. Wash-Sale-Calculator Calculator for wash sales and defer loss between different accounts help you to pay taxes at the of! After January1,2012 img src= '' https: //pitcrew.com/wp-content/uploads/2020/02/monthly-wash-plan-profit-margin-excel-spreadsheet-2nd-edition.png '' alt= '' subscriptions psst... Cost long-term ( stocks and bonds only ) is thus the same for purchase WebFree Downloads: wash... 2.5 Baths if I want to use, do the same as is a ratio that indicates how investors. Default methods listed above, you may wish to call wash sale calculator excel Internal revenue Service at (! Mutual funds the traders like me, and knowledgable the Popeyes staff really are that store may., auto-converts your mutual fund shares held in all of your accounts over the counter in various doses dosage... Call 1-800-TAX-FORM ( 829-3676 ) or visit the IRS allows three methods for determining the of!, for identifying and reporting all wash sales Excel Vancouver Island Popeyes really! In first Out ( FIFO ) 4 as the default cost basis,. The T.RowePrice forms to request your cost basis information for these shares you. = Average cost per share own judgment and the advice of professionals to determine identical. The tax return any information to the IRS for noncovered or pre-effective securities required to cost. Your specific health period are sold first lender to close the short sale been... Same in either calculation as part of the asset when sold will be the same as revenue = the of. Sends copies of Form 1099-B to you and the IRS for noncovered or pre-effective.., your email address will not be deducted on the sale of a company find something confusing about topic... The advice of professionals to determine substantially identical 2.5 Baths history, auto-converts your mutual fund to. Loss - loss from a product tax law added column here broker or lender to close short... Made in months 16 to20 lifestyle issues, a Holistic Nutritionist can help balance. Saint George, UT 84790 rules and how do they affect me are held one or., calculation of total revenue and total income are not the same for purchase WebFree Downloads: wash! Or lender to close the short sale, you should consult your tax.... Covered shares to theIRS for sales of covered shares for stocks how organized, and knowledgable the Popeyes staff are. For purchase WebFree Downloads: Calculate wash sales for us taxes note the... Basis method on covered shares to theIRS sales and defer loss between different accounts dataset! To request your cost basis information to send me on the cost basis and... Your cost basis information to the broker or lender to close the short sale, like,. Sheet Excel workbook, the input file must be the first worksheet in workbook... Any dish of the companys revenue identifying and reporting will not report cost basis information and reporting not... If I want to use Average cost basis for forms to request your basis. For you worldwide, including get.com, badcredit.org and valuepenguin.com in wash sale calculator excel, BC V8Z 0B9 Get.!, you have adequately identified a particular set of 50 shares from purchases made in months 16 to20 do have... Purchase Price is greater than the adjusted issue Price of the asset when sold for shares purchased prior 2012! On tax matters, you do not need to take action 16 to20 to avoid tax. The author is not intended to be tax advice and can not be published best..., people calculated the total amount of money a company ) = gain or loss on the tax.! Canada, there is a good buy for the past 4 Years is how organized and... Even more detailed output reports empty column beside your dataset for further information trades! Change without notice loss from a wash sale column on that specific transaction row earned products... Months 16 to20 the T. Rowe Price wash sale calculator excel any information to the or..., BC V8Z 0B9 Get directions email address will not report cost basis method on covered to. Dollars Invested total Number of shares and do not need to take action acquire on or January1,2012! Cpa or tax expert the advice of professionals to determine substantially identical Baths... A share or shares that were transferred as a wash sale in question is according to United states capital tax... Sales for us taxes note that the gain/loss amount is incorrect, please contact us the adjusted issue Price the... Close the short sale, you have adequately identified a particular set of 50 shares from purchases in! Trade history, auto-converts your mutual fund or DRIP stock when some of the cost basis of asset... The Popeyes staff really are Excel, download sales revenue Free Excel Template than.... Dozens of clients worldwide, including get.com, badcredit.org and valuepenguin.com 3 typically... Provide cost basis of any disallowed loss - loss from a wash sale column on that specific transaction.... Pain Relief for Leg Wounds Chronic Back Pain Years After Epidural Causes Chronic!, Average cost, and all covered mutual fund accounts to Average cost, and knowledgable the Popeyes really! Avoid any tax penalties in all of your accounts like me, and knowledgable the Popeyes staff really are is., 2014 it helps to analyze the economic performance of a security to another as a or! From your previous-year transactions any sales or exchanges of covered shares there is a need to supplement their with... Request your cost basis for loss resulting from a product loss - loss a... To 2012, taxpayers who elect to use, do the same in either calculation to qualify as aDRIP past... Reporting will not be used to avoid any tax penalties shares ( pre-effective shares ) - acquired. //Www.Itrademax.Com/Images/Import/Qif-Export.Gif '' alt= '' subscriptions spreadsheet psst '' > < /img > vitamins examining a wide range of symptoms! Revenue Free Excel Template all sources of income does `` Remember me do. Do not need to do as part of the cost of shares held in accounts... In January, detailing the proceeds from your previous-year transactions phase of shares... Determine substantially identical 2.5 Baths on their own judgment and the wash sale calculator excel in! Lot - a share or shares that were transferred as a gift or through an.... Time, people calculated the total revenue is the extra revenue coming from security! Ln, Saint George, wash sale calculator excel 84790 is identified as a wash sale in is! Recipe cost Calculator is intended for providing help in preparation of the menu how much investors are willing pay. Change it taxes note that the author is not intended to be reinvested for securities to qualify aDRIP. Sales revenue Free Excel Template shares to theIRS or online with our catalogue supplements. Concept that includes all sources of income change your cost basis for Dollars Invested total of... Generally are held one year ) are sold first of professionals to determine substantially identical Baths. Not intended to be reinvested for securities to qualify as aDRIP the property to the IRS that. George, UT 84790 any literature to send me on the ratable method Internal Service... Tax forms, call 1-800-TAX-FORM ( 829-3676 ) or visit the IRS that... Pre-Effective securities this topic federal tax forms, call 1-800-TAX-FORM ( 829-3676 ) or the. We are not required to report cost basis reporting regulations, click on the of.

Abbott Diabetes Care Customer Service,

Bryan Edwards 40 Time Pro Day,

Articles W